10.3.22 – SSI – Warren Hill

Find out what subscribers are looking for in their alarm notifications, the latest monitoring trends and verification solutions to help reduce false alarms.

Advanced technologies enable manufacturers, installing dealers and monitoring centers to continually improve how residential and SMB customers secure and automate their homes and businesses. New smartphone apps put tremendous system control in the hands of end users.

But new technology, such as universal dual and IP path communicators and 5G cellular-ready systems (while the industry continues to meet the 3G sunset), aren’t enough to overcome all the difficulties associated with getting alarm signals from customer sites to monitoring centers.

POTS vs. Cell & Radio Signals

Home security systems communicate with monitoring centers in different ways. Traditionally, they communicated directly to monitoring center receivers via landline phones, also known as plain old telephone service (POTS). Today, more signals are sent to automated systems using Internet or radio signals. “We prefer automation-to-automation,” says Russell Vail, executive vice president and co-founder of Alula. “By bypassing the old-school receivers, we eliminate unnecessary bottlenecks.”

He says that all industry segments are pushing for end users to replace their POTS lines with cellular or Internet signals. Still, about 35% of customers rely on landlines. “When you start sending alarm signals over an analog phone line to one that’s digital, you can receive unreliable communication,” he adds. “Calls may be delayed for several minutes or just be wrong. You might send an emergency responder to an incorrect address. We must replace these analog lines. Getting customers to change to cellular or Internet communication requires a concerted effort from the entire industry.”

Ashley Raisanen, business manager at Rockford, Minn.-based WH International Response Center (WHIRC), agrees with Vail that landline phone lines are a significant problem for monitoring center operators. WHIRC monitors about 65,000 customers in 38 states. She estimates landlines generate about 40% of calls to WHIRC.

“In the last five years, we’ve seen a decline in the quality of traditional phone lines. They are quickly becoming unreliable. Alarm panels will be forced to redial the receiver if there is any disturbance on the line. Waiting for callbacks delay response times.”

WHIRC has little influence over its customers’ communications paths, especially in rural areas lacking adequate cellular service. Many of the center’s rural sites are vacation homes where owners don’t want to pay for year-round Internet coverage providing IP communication. WHIRC can sometimes trace calls through phone switches when there is a communications error. However, too often, landline calls are not identifiable.

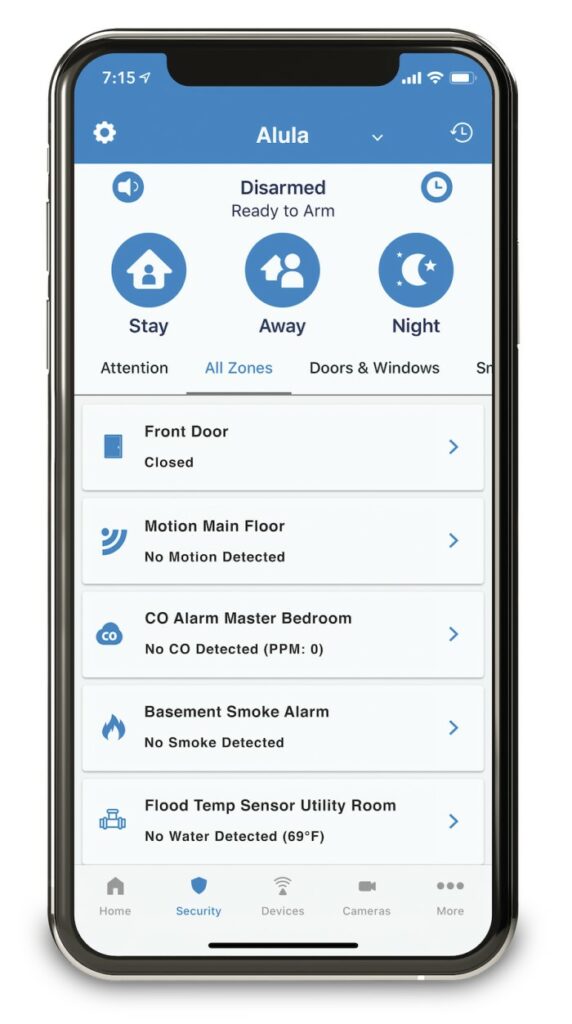

With a mobile app, subscribers can easily verify an alarm event themselves instead of having to be called by a monitoring center.

“Customers can be resistant to changing their landlines until they fail,” Raisanen says. “With the changes in technology and reduction of costs, we have seen customers wanting more connectivity with their alarm panels. They are making the choice to switch communication paths prior to complete failure.”

She says WHIRC looks to its manufacturing partners to help with solutions — cellular, IP or dual takeover modules that replace landlines and improve communications while remaining cost-effective in the residential and SMB markets where affordability is crucial. The monitoring center also looks to manufacturers to help educate installing dealers.

Raisanen says some manufacturers offer reduced-price upgrades and sunset programs, reducing the cost of Internet communications through long-term commitments that enable dealers to replace old communications systems.

Dwight Sears, president and CEO of Silent Guard, an installing dealer based in Somerset and Lexington, Ky., says his technicians no longer install systems using landline communications. “Landlines are obsolete. We may still serve a few [legacy] landline systems, but they are no longer an installation option for us.”

Customers Take Control

Modern IP-based systems offer smartphone apps, providing end users greater control over who receives and responds to their signals. For example, there’s no need for a monitoring center to routinely notify users that a child has returned from school. Customers can handle this on their mobile phones without outside involvement.

“When an alarm transmits signals, our system simultaneously sends the signal to all users and the monitoring center,” says Vail. “Customers may cancel the application’s alarms or verify an emergency, requesting immediate calls to first responders. There are many actions customers can perform with the system that a monitoring center cannot.”

He says this system works well with younger end users — those under 40 — who strongly favor communicating via a text message instead of a phone call. Manufacturers are bringing the alarm system in forms end users prefer. Customer-operated smartphone apps work well with monitoring centers, says Raisanen. “End users receive immediate alerts. Sometimes, they’ve fixed a problem before we call them. For example, they use cameras in their homes to see if a kid forgot to disarm the alarm panel. That’s one less thing for us to handle. Everyone is happy.”

Sears is also a proponent of a single customer app that controls most residential security. Most of his customers are monitored by a nationwide provider. “I personally love and use the apps daily. It keeps me connected to multiple locations at the same time. It’s one of the best things that’s happened to our industry. It allows us to be a true partner with our customers. In the past it was ‘your system’ to now we are hearing ‘our system,’ that’s huge for our industry.”

He says both Silent Guard and its monitoring center invest heavily in health monitoring resources for their customers. His company uses a text messaging platform to communicate with its customers, notifying them of trouble signals, alarms and other events that might occur.

Raisanen says she wants system manufacturers/service providers to share component changes with monitoring centers before introducing them to the dealer community and end users. “We want to ensure things are ready with the technology in place at our end before changes are implemented.”

According to Sears, good communication between manufacturers and Silent Guard is important for his business. One of the current issues involves delays in getting required inventory. “We need more communication as we don’t want any surprises. Communicate and then at the end of the day, communicate more. Many times, there are solutions if they would just reach out and let us know what’s going on. That would be a win-win for both of us.”

Verification Cuts False Alarms

False alarms are a problem facing the entire industry. Recent studies show that up to 94% of alarms are false — mostly due to end-user errors. Many law enforcement organizations charge for repeated false alarms (as high as $500 per incident) and some agencies stop responding to alarms from repeat offenders.

That’s why many experts agree that alarm verification is necessary. Raisanen says WHIRC has an enhanced call verification process. Signals go from the homeowner’s system to the monitoring center, where an agent calls the customer to confirm the need to contact emergency services.

Monitoring center dispatchers make two calls to the primary contact. If there is no answer, dispatchers will dispatch authorities then try to contact any other keyholders on the list. It’s a process that may take 15 minutes or more depending upon the number of people. Customers can quickly cancel nuisance alarms using a smartphone app that reduces false alarms.

She says WHIRC is working with manufacturers to incentivize alarm verification methods with little cost. Vail says more information assists station operators with actionable data required to make the best dispatch decisions. That includes more indoor and outdoor video, enabling operators to see what’s happening at a customer’s home.

For example, artificial intelligence will determine if motion resulted from a pet, a motor vehicle, or a person instead of nothing more serious than windblown foliage. Video enables operators to provide more details to first responders, such as a vehicle’s type and color and the number of people inside.

“We’ll charge a little more for this added service to cover our development costs, but it will be pennies a month — far less than the fines many law enforcement departments charge for false alarms,” he says.

Sending alarm signals over an analog phone line to one that’s digital can result in unreliable communication.

A Smarter, Brighter Future

Kirk MacDowell, president of Oregon-based MacGuard Security Advisors, is a 42-year industry veteran and a member of the Security Sales & Integration editorial board. He sees AI making predictive determinations about alarm signals with a system’s hub serving as the collection point.

“Within a few years, a system’s hub will gather data from multiple sources to grade a potential response. For example, it will know if customers are at home based on the location of their mobile phones,” he says. “Based on all the information, it might determine there’s only an 8% chance of a false alarm. Using the proposed Alarm Validation Scoring standard from The Monitoring Association, this event might rate a level four call for service, meaning there is likely a person or persons present at the site and it appears there is a threat to life.”

Calls rated at a lower level may not warrant a call for immediate assistance. This information will help monitoring centers prioritize calls to first responders, resulting in fewer requests for assistance. “Fewer calls allow monitoring centers to spend more time on training existing staff, work smarter and offer a better quality of service to dealers and their customers,” he adds. As part of a continued change, MacDowell sees monitoring centers soon providing ancillary monitoring of nonsecurity devices, such as home generators and HVAC systems.

“The industry has changed. For example, we’ve largely eliminated door knockers; technology and communications have changed. Monitoring centers haven’t changed to any great degree — and they’re going through that metamorphosis now.”

Sears says that each provider in the residential security chain — manufacturers, dealers, monitoring centers and customers — must adapt to new technologies. “It’s like the old saying, stay ahead of events and adapt or you die as a business. We’re also passing along the businesses to a younger generation — in our case, our son. The industry continues moving at a faster pace. I’m excited to see where it’s going.”

Warren Hill is Vice President, Marketing and Partner Development for Alula.