2.12.21 – Baltimore Sun

Maryland lawmakers got a pandemic financial aid bill back on track and secured its final passage Friday by backing down on an effort to include immigrant workers, with Democrats promising to instead pass a separate bill to help them next week.

Republican Gov. Larry Hogan proposed the RELIEF Act and had agreed to various changes made by Democratic lawmakers during constant negotiations that were solidified early this week.

But a push in the House of Delegates to include noncitizen workers — including some with legal status and some without — threatened to derail the act. By Thursday, Hogan said that further changes put his support for the bill in jeopardy. To get the bill back on track, House Speaker Adrienne A. Jones and Senate President Bill Ferguson agreed to remove the provision for immigrant workers.

Hogan plans to sign the bill into law Monday. As an emergency bill, it would take effect immediately, allowing the state comptroller to send out the direct payments as soon as next week and make quick changes needed for tax filing season.

“It will help Marylanders barely hanging on right now as we work to bring this global pandemic to an end,” Hogan said in a statement on his social media accounts.Hogan proposes $1 billion COVID-19 relief »

The legislature’s Democratic leaders promised to pass a separate bill to allow workers with low incomes who aren’t citizens to receive the earned income tax credit benefit at the state level. The credit lets people keep more of their earnings, incentivizing work. But federal law bars taxpayers from receiving it if they file taxes with an individual taxpayer identification number instead of a Social Security number.

“No Marylander deserves to wonder where their next meal will come from, how to buy their child’s diapers, or how to pay for lifesaving medicine — especially when they go to work every single day,” Jones and Ferguson said in a joint statement.

Jones and Ferguson said the follow-up bill would provide more help for immigrant workers than what they would have received under the RELIEF Act.

If the separate bill is successful, Maryland would join Colorado and California in extending earned income tax credit benefits to taxpayers who use individual taxpayer identification numbers, according to the Maryland Legislative Latino Caucus.

“This is a testament of our caucus’s commitment to all our state’s residents, especially those who have been working on the front lines during this historic pandemic,” said Del. David Fraser-Hidalgo, a Montgomery County Democrat and chair of the caucus.

The announcement capped a whipsaw two days in Annapolis where the RELIEF Act went from a speedy path to passage to being thrown in jeopardy and then getting back on course.

“Today is a good day because we are going to do a lot of good work for the people of Maryland,” said Del. Eric Luedtke, the House Democratic majority leader from Montgomery County who was one of the chief negotiators.

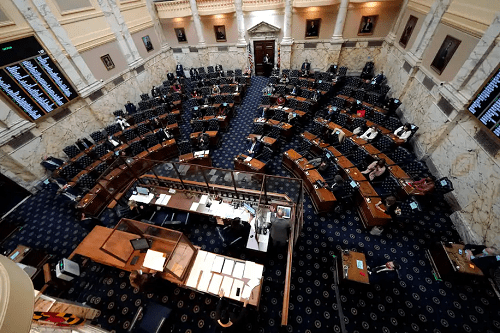

The House voted 128-1 Friday afternoon to pass the RELIEF Act, followed by a 45-0 vote in the Senate less than an hour later. The only lawmaker to vote against the bill was Del. Rick Impallaria, a Republican representing parts of Harford and Baltimore counties.

Sen. Michael Hough, the Republican minority whip in the Senate, said the RELIEF Act’s passage represented a “true bipartisan moment.” He said he didn’t agree with every provision in the bill, but thought it was a good product nonetheless.

“It’s not a perfect bill, but compromises are never perfect,” said Hough, who represents parts of Frederick and Carroll counties.https://www.instagram.com/p/CLNWtYQrFud/embed/captioned/?cr=1&v=13&wp=822&rd=https%3A%2F%2Fwww.baltimoresun.com&rp=%2Fpolitics%2Fbs-md-pol-ga-final-relief-act-20210212-sga25gb3ofbghc4erfa2a2uudq-story.html#%7B%22ci%22%3A0%2C%22os%22%3A38634.00000002002%7D

The final version of the RELIEF Act includes one-time direct payments to people with low to moderate incomes, defined as those who receive the earned income tax credit, of $300 per individual or $500 for a couple. It also would expand the amount of the benefit that workers receive under the earned income tax credit for three years.

The comptroller’s office will start sending out the payments to 400,000 taxpayers who qualify as soon as the bill becomes law. Most people will receive direct deposits next week in the accounts on file from their past tax returns, while others will receive checks, said Susan O’Brien, a spokeswoman for Democratic Comptroller Peter Franchot.

Keep up to date with Maryland politics, elections and important decisions made by federal, state and local government officials.

The legislation also would eliminate the need for people to pay state and local income taxes on unemployment benefits received in 2020 and 2021, although it would limit that tax break to those who had income in those years of less than $75,000 for an individual or less than $100,000 for a couple.

Aid to businesses would include allowing small businesses to keep the sales taxes they collect for up to three months, up to $3,000 per month. Businesses that received state pandemic assistance, including grants and forgiven loans, would be exempt from paying state taxes on that money.

Employers who laid people off during the pandemic would not have to pay increased unemployment insurance taxes. Businesses with fewer than 50 workers would be able to postpone paying unemployment taxes for a year.

The RELIEF Act also has directives to spend hundreds of millions of dollars on programs ranging from grants to nonprofit groups to education initiatives to help for small businesses.https://platform.twitter.com/embed/Tweet.html?creatorScreenName=baltimoresun&dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1360359220458250241&lang=en&origin=https%3A%2F%2Fwww.baltimoresun.com%2Fpolitics%2Fbs-md-pol-ga-final-relief-act-20210212-sga25gb3ofbghc4erfa2a2uudq-story.html&siteScreenName=baltimoresun&theme=light&widgetsVersion=889aa01%3A1612811843556&width=550px

The governor and lawmakers from both parties expressed a desire to act swiftly to get additional help to those who have struggled the most in the pandemic, which they defined as low-income residents and small businesses.

Sen. Craig Zucker, a Montgomery County Democrat, said the passage of the bill sends a message: “Relief is on its way. Not next year, not in the next month, but now.

Pamela Wood covers Maryland politics from The Baltimore Sun’s State House bureau in Annapolis. She’s been with The Baltimore Sun since 2013, and previously wrote for The Capital, the Maryland Gazette, the Daily Times (Salisbury) and Gannett News Service. She grew up in Howard County and graduated from the University of Maryland.