10.7.21 – SSI – Elizabeth Parks

Competition from DIY solutions, low-cost smart home devices, new business models, new partnerships, emerging technologies and new entrants continue to transform residential security.

Editor’s Note: SSI has partnered with Parks Associates for the creation of DIY FYI, a column designed to help dealers keep track of important smart home market developments, what the competition is and whether they want to jump into something they see as a new opportunity.

Residential security services are being redefined. In recent years, the penetration of home security systems has experienced meaningful growth. Consumer choice for installation, bundles of devices and monitoring services is the focus for both professional and DIY solutions.

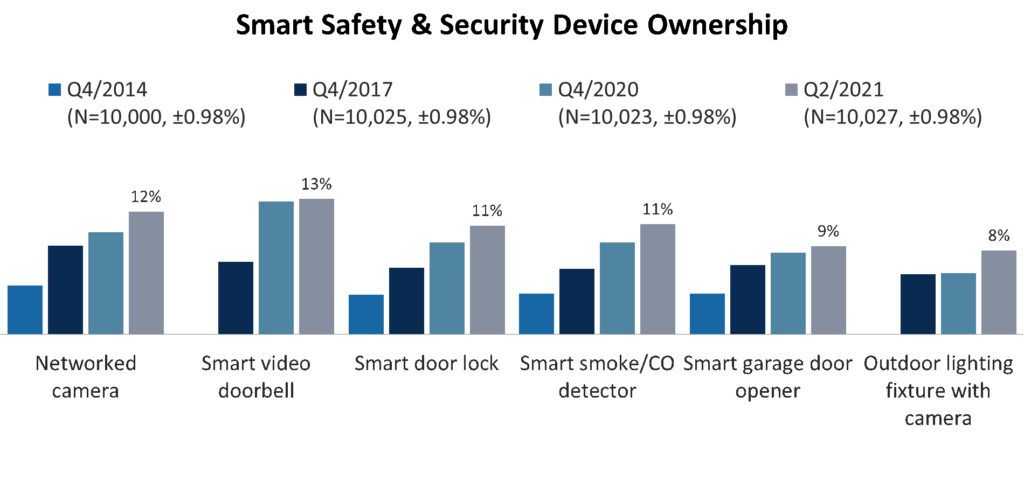

Smart home products are becoming substitutes for traditional home security systems and creating an onboarding ramp to professional services.

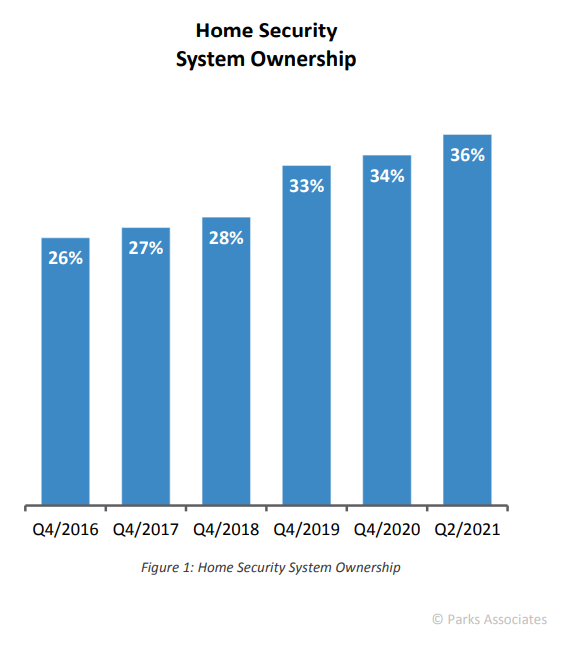

Parks Associates’ survey research reveals that 36% of U.S. households in Q4 2020 own a home security system, up from 26% in Q4 2016. While the jump in ownership is impressive, it also remains true that there remain 64% of households, or approximately 69 million homes, without a home security system.

The adoption of interactive services with home security systems also continues to rise. Parks Associates research shows that 13% of U.S. broadband households intend to purchase a security system over the next 12 months. COVID-19 has impacted the market positively and negatively, but its singular impact has been a renewed focus on security and peace of mind.

Home security systems help households protect the people and things they care about most, while security-adjacent use cases with the strongest appeal protect motor vehicles and pets. Security system owners and non-owning purchase intenders generally share the same priorities for what they desire to protect. After loved ones, personal space, and home structure prioritize protecting cars, electronics, and pets.

Competition from DIY solutions, low-cost smart home devices, new business models, new partnerships, emerging technologies and new entrants continue to transform the residential security market. Parks Associates’ latest industry report reveals that 42 % of home security owners self-installed their home security system and as of Q4 2020, 59% of new system buyers chose self-installation. Choice in installation for customers is critical and the industry is responding by providing new options.

Parks Associates’ new research shows that most broadband households continue to purchase their security systems from security dealers, by phone, online, or from a company selling door-to-door. Online retail, though, continues to grow as a channel for consumers for smart home security devices as DIY system sales increase.

The increased competition in the professional monitoring market across security solutions is driving down professional monitoring costs. With security providers expanding their solutions to address a broad spectrum of client security needs, there has been a steady decline in the price of professional monitoring services, making differentiation challenging.

From a technology standpoint, the residential security industry has been innovating over the past several years. Security providers and device manufacturers are preparing for the 3G sunset and the challenges that come with it. The big cellular carriers announced they intend to shut down 3G technology by 2022 for the faster and more advanced 4G LTE and 5G technology.

Facial recognition capability has emerged as a differentiator, but the success of its functionality is debatable, and it faces significant headwinds. As it becomes more popular, future industry competition must involve additional or more advanced AI capabilities, including facial recognition or personalized responses, to stand out.

First, facial recognition is not always reliable, and second, some solutions are better than others. At the same time, U.S. policymakers are curtailing the use of facial recognition technology.

There is a considerable market opportunity for residential security service providers to build on their core offering, chiefly by cultivating peace of mind value propositions for security-adjacent use cases. Certainly, macro events like the recent pandemic have impacted consumers’ purchase behavior around residential security capabilities.

Elizabeth Parks is President of Parks Associates. For more information on key trends and the changing competitive landscape for the home security market, such as the adoption of home security systems, the impact of COVID-19 on the market, and more, please visit, www.ParksAssociates.com.