3.17.23 – CE Pro

Healthcare consolidation spikes workers comp physician costs by 8%. Average co-pay cost for hurt technician rises by $29-$91 per treatment.

At some point it happens to every custom integrator company… one of your technicians is going to be injured on a job. And it is going to cost you and your employee a lot more than it used to cost to handle that workplace injury.

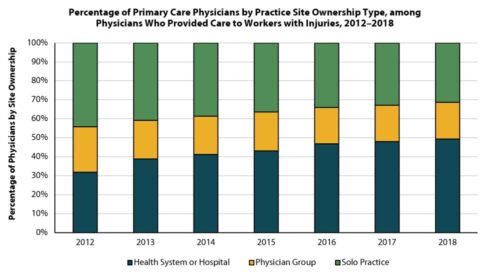

To address a sliced finger to a slipped disc or something worse, the co-pay cost outside of your workers compensation coverage is rising dramatically due to healthcare consolidation, according to a new study from the Workers Compensation Research Institute (WCRI). The rising costs are primarily due to the vertical integration of medical providers characterized by hospitals that have acquired physician practices. According to the study, as of 2018 49% of medical practices are now owned by hospitals or healthcare systems. That is up from 32% in 2012.

The same trend applies to orthopedic surgeons who might take care of that broken arm or herniated disc, as 35% of orthopedic doctors’ practices are now owned by hospitals, up from 18%.

According to the workplace injury costs study, the vertical integration (physicians becoming part of a hospital or a health system) increased the average payment per procedure by 8%, which translates to an average $29 increase in that measure. The effects of vertical integration on medical payments were larger in the states that did not regulate payments for physicians through fixed-amount fee schedules. Vertical integration resulted in a $91 increase in the average payment per procedure in the non-fee schedule states.

“Medical markets are increasingly concentrated. This means that patients are more likely to be treated by physicians at sites owned by hospitals and health systems,” said John Ruser, WCRI president and CEO. “This raises a policy concern that the increasing concentration of medical providers may lead to higher payments for medical care without corresponding improvements in patient outcomes.”

The study, Impact of Medical Provider Consolidation on Workers’ Compensation Payments, is the first to focus on the effect of vertical integration in workers’ compensation. Prior studies, of group health markets, found evidence of increasing prices as one of the main outcomes of the growth in provider consolidation. Economists expect that increases in provider consolidation lead to higher bargaining power of these providers over prices and, in turn, result in higher payments for care. Furthermore, provider consolidation may lead to more instances of facility fees being included in medical bills for similar types of care that are provided by vertically integrated physicians. This analysis is the first in a line of proposed studies examining how the growing consolidation of medical providers affects care delivered to workers with injuries.

For integrators, the importance of stressing safety on the jobsite is paramount.

ABOUT THE AUTHOR

Jason Knott is Chief Content Officer for Emerald’s Connected Brands. Jason has covered low-voltage electronics as an editor since 1990, serving as editor and publisher of Security Sales & Integration. He joined CE Pro in 2000 and serves as Editor-in-Chief of that brand. He served as chairman of the Security Industry Association’s Education Committee from 2000-2004 and sat on the board of that association from 1998-2002. He is also a former board member of the Alarm Industry Research and Educational Foundation. He has been a member of the CEDIA Business Working Group since 2010. Jason graduated from the University of Southern California.

View Jason Knott‘s complete profile