6.19.22 – Clarion Ledger

The state’s newest laws will take effect July 1, including tax cuts, medical marijuana and a new official state song.

The Mississippi Legislative session, which ended in April, also saw the legislature pass a record budget, as states throughout the nation are flush with federal cash.

State budget and ARPA funds

The state’s $7.32 billion budget, more than 9% larger than the previous one, was buttressed by $1.5 billion in federal relief funds from the American Rescue Plan Act. Over $295 million in available federal funding was left on the table, but the legislature will have another opportunity to spend that money next session.

Roughly half of the state’s ARPA funds will go to cities, counties and rural water associations. The appropriation will allow the state to match local contributions to improving water and sewage infrastructure. City and county governments are also receiving $900 million directly from the federal government through ARPA.

One aspect of ARPA funding the legislature approved ended up being carved out through a veto by Republican Gov. Tate Reeves — $50 million that had been set aside for capital improvements at University of Mississippi Medical Center. In vetoing the measure, Reeves cited disputes between the state-owned hospital and private insurance providers, specifically Blue Cross and Blue Shield of Mississippi.

Read this:New death penalty law sets Mississippi apart with more leeway in methods of execution

Previously:Mississippi set to become final state with equal pay law

“There is little reason that Mississippi taxpayers should radically increase the commitment to further subsidize the operations of UMMC to the detriment of competitors,” Reeves said in a statement.

Reeves has also had public disputes with UMMC’s dean, LouAnn Woodward, after she criticized his handling of the COVID-19 pandemic, though Reeves did not cite that as a reason for cutting the funding.

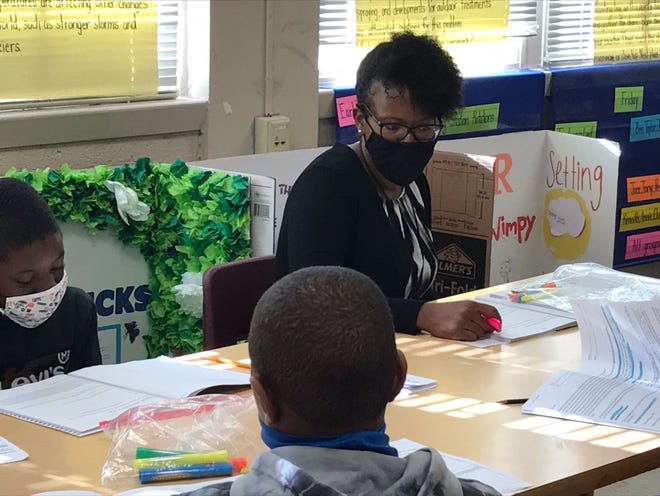

Education funding and teacher pay raise

Despite the record-breaking budget, the program that provides the state’s portion of funding for public school districts will not be fully funded. Even with an increase in funding, the Mississippi Adequate Education Program will fall about $304 million short of what it needs, said Senate Education Chair Dennis DeBar, R-Leakesville. The expected $83.2 million increase in MAEP funding will likely be insufficient due to inflation combined with funding two consecutive years of the legislature giving teachers a pay raise.

This year’s raise, outlined in House Bill 530, will see the largest ever increase in Mississippi teacher pay. The minimum annual salary for public school teachers will increase by $4,515 to $41,638. The average teacher’s pay will increase by more than $5,000. According to the Southern Regional Education Board’s Teacher Compensation Dashboard the average teacher in the state made $46,843 during the 2019-2020 school year.

Tax cuts

House Bill 531 will bring the largest tax cut in Mississippi history. While the cut passed with bipartisan support, it did not go as far as some had wanted — including Gov. Reeves. He was part of a group that sought to eliminate the state’s income tax entirely, putting Mississippi alongside states, including Texas and Florida, which do not have a state income tax.

Instead, a plan championed by Republican Lt. Gov. Delbert Hosemann will see the state’s income tax gradually reduced to a 4% flat tax on income over $5,000. Starting July 1, taxes on that amount will drop from 5% to 4.7%. In 2025 it will drop again to 4.4%, and then in 2026 it will bottom out at 4%.

Medical marijuana

Starting July 1 Mississippi will officially have a medical marijuana program, more than a year and a half after it was overwhelmingly approved by the voters, only to be struck down in court months later.

Senate Bill 2095 was largely a response to that decision, enshrining medical marijuana legalization into state law.

More than two dozen conditions and symptoms — including cancer, Parkinson’s, Alzheimer’s, autism and seizures — will allow Mississippians to qualify for a medical marijuana card.

The state Department of Health began accepting applications June 1 through their online portal and more than 1,800 people had registered for accounts in the first six days. Department officials also said it will likely be months before businesses are licensed to sell marijuana and have had enough time to grow and test their products. The Department of Revenue will begin reviewing applications for businesses to operate as dispensaries on July 1.

Parker’s law

House Bill 607 is named after Parker Rodenbaugh, a former Madison Central High School and Mississippi State University student who died in 2014 after taking a synthetic drug. Parker’s Law will explicitly list “fentanyl delivery resulting in death” as a crime punishable by 20 years to life in prison.

Parker’s Law:As fentanyl deaths spike, Mississippi imposes harsher penalties on dealers

The man who supplied Rodenbaugh with the drugs that killed him was initially convicted of drug trafficking and second-degree murder, but the murder conviction was later dismissed during appeals.

Critical race theory ban

Along with states throughout the nation, particularly Republican-led states in the South, Mississippi passed a law attempting to ban what many refer to as “critical race theory.”

Critical race theory is an interdisciplinary movement which originated among legal and civil rights scholars. It attempts to link racial inequality with various social, educational, legal and criminal justice outcomes, both historically and in modern contexts.

Senate Bill 2113 attempts to ban the teaching of CRT by withholding funding from any educational institution that directs or compels “students to affirm that any sex, race, ethnicity, religion or national origin is inherently superior, or that individuals should be adversely treated based on such characteristics.” The bill further states, “no distinction or classification of students shall be made on account of race other than the required collection or reporting of demographic information.”

New law:Mississippi driver’s license can be expired up to five years before test required

Previously:Report: U.S. Supreme Court will overturn Roe v. Wade in Mississippi abortion case

COVID-19 vaccine mandate ban

House Bill 1509 prohibits any government entity, including public colleges and universities, from requiring vaccination against COVID-19. Healthcare facilities are exempt from the law if a vaccine mandate is recommended or required by the Centers for Disease Control and Prevention, or in order to receive Medicare and Medicaid funding.

Death penalty methods changed

The methods by which convicts can be executed will change due to House Bill 1479. The current standards, approved in 2017, laid out specific requirements for a lethal injection, and then gave alternatives to lethal injection in sequential order of preference. The new changes remove those requirements for the injection and the preference order for alternatives. While lethal injection remains the state’s preferred method, the alternative that will be used in the event it is not possible will be up to the Department of Corrections. Possible alternatives include electrocution and firing squad.

“Go Mississippi” no longer state song

After 60 years as the official state song, “Go Mississippi” is being replaced by “One Mississippi.”

“Go Mississippi” had been criticized for its ties to former Democratic Gov. Ross Barnett, an ardent segregationist. The departing state song had different words, but it borrowed the tune from his campaign song which included the lines, “For segregation, 100%. He’s not a moderate, like some of the gents.”

The new song, “One Mississippi,” was written by Greenville native Steve Azar as the bicentennial song for the state. It will officially be designated as the “contemporary” state song, while the newly established state songs study committee considers additional state songs from various eras and genres.

Other laws taking effect July 1

Hundreds of other laws and resolutions will take effect July 1. Some of those will prohibit discrimination against those with disabilities, remove a ban on hearing aid coverage from the state health plan, allow food trucks to acquire liquor licenses, protect student political speech and make changes to the state’s name, image and likeness laws for student-athletes.

The City of Jackson also saw its taxation authority extended to 2026, as it was set to expire. The tax on hotels, motels and restaurants funds the Jackson Convention and Visitors Bureau.