12.24.24 – Federal Reserve Bank of Dallas

The Texas economy exhibited recent signs of expansion, though job growth has slowed. A measure of economic activity, the Dallas Fed Texas Business Outlook Surveys (TBOS), shows moderate gains in services revenue, a resumption of retail sales increases and stable manufacturing production.

The Texas economy exhibited recent signs of expansion, though job growth has slowed. A measure of economic activity, the Dallas Fed Texas Business Outlook Surveys (TBOS), shows moderate gains in services revenue, a resumption of retail sales increases and stable manufacturing production.

Home sales and energy activity are flat, according to the Beige Book, and bank lending declined slightly, the Banking Conditions Survey found.

Business outlooks improved in November, with widespread increases in demand expectations. The declining federal funds rate has had an overall positive, albeit mild, effect, with most businesses requiring additional time to see if there will be a more robust impact and others citing rising long-term interest rates as a headwind.

Survey contacts were markedly more positive than negative about prospective economic conditions under the incoming Trump administration, though some worry about potential trade and immigration policy changes.

Employment growth exhibits volatility

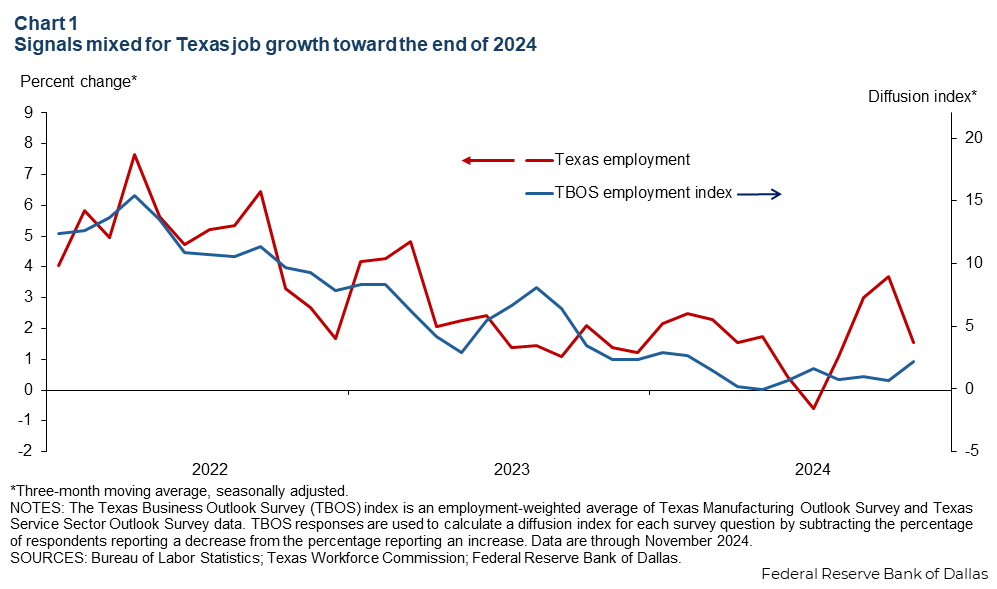

Job growth has decelerated recently and, coupled with downward revisions for the first half of 2024, is below trend for the year. For the year through November, job growth cooled to an annualized 1.6 percent from 2.4 percent in 2023. Benchmark data revisions pared second quarter growth from 1.8 to 0.4 percent. The number of Texas jobs grew at an annualized 0.9 percent in November, a deceleration from the stronger pace posted in the third quarter.

TBOS provides an alternative measure of job growth. While the surveys do not measure the number of jobs created, they provide a broad measure of employment trends by calculating the share of companies adding employees in each month minus the share trimming payrolls. This diffusion index, which is not subject to revision, is a weighted average of two separate data series, the Texas Manufacturing Outlook Survey (TMOS) and the Texas Service Sector Outlook Survey (TSSOS). It showed increased hiring in November (Chart 1). Job growth gains were broad based, with the largest additions in manufacturing and retail.

Texas firms’ outlooks more optimistic

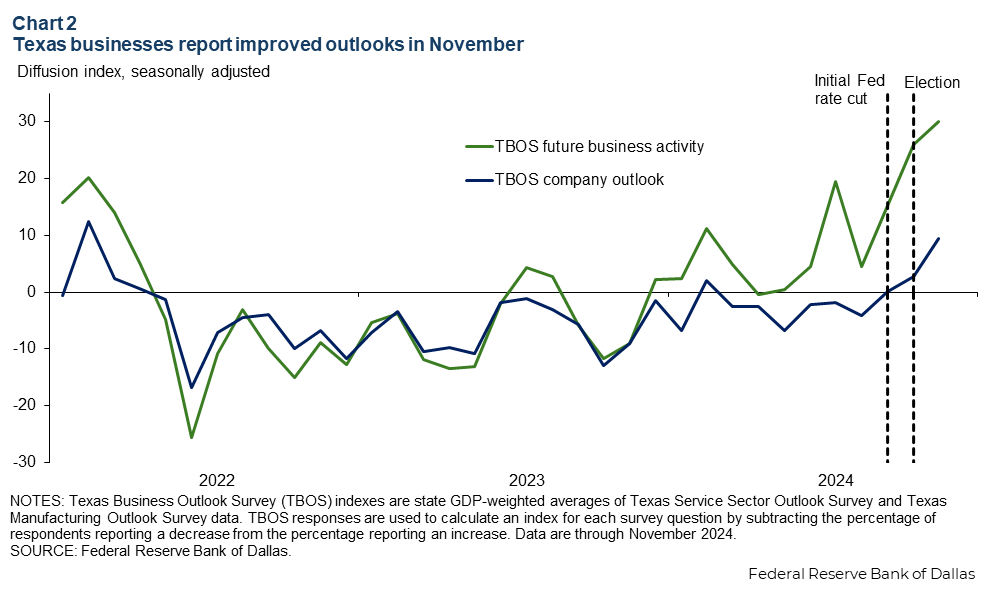

The TBOS company outlook index, a similarly weighted average of TMOS and TSSOS, turned positive, ending a two-year run of negative readings (Chart 2). Negative values indicate firms’ outlooks have worsened month to month on net, while positive values indicate they have improved.

The outlook index stabilized in September following the Federal Reserve’s initial policy rate cut that month. The index pushed into positive territory in October and moved higher yet after the November general election. Another forward-looking index, firms’ expectations for general business activity six months ahead, also advanced.

Large firms (those with at least 500 employees) were markedly more optimistic than small firms (those with fewer than 100 employees). The outlooks of energy-related manufacturing industries were most improved along with services and leisure and hospitality. A transportation services contact expressed a belief that “the new administration will enact policies that will increase oil and gas production.” It bears noting that energy production hit a record high in 2023 and continues to edge higher.

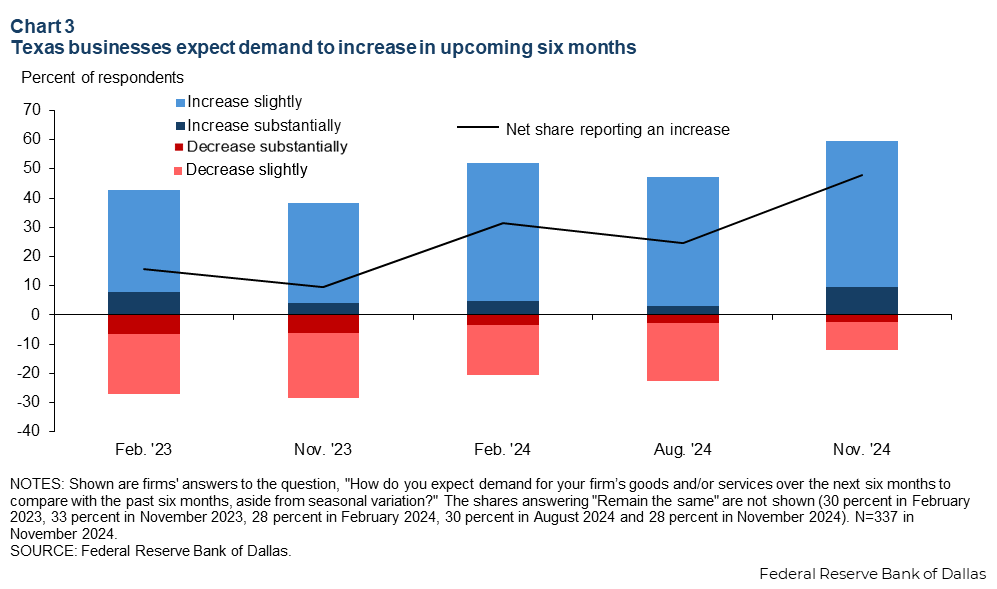

A TBOS special question on demand outlooks provided additional insight. It, too, reflected improvement after mixed outlooks in August. Respondents were asked about their expectations for demand for their firm’s goods and/or services over the next six months relative the prior six months, aside from seasonal variation (Chart 3).

A greater share of firms expects an increase, and a smaller share expects a decrease. This was especially true among manufacturers, leisure and hospitality, and transportation services companies.

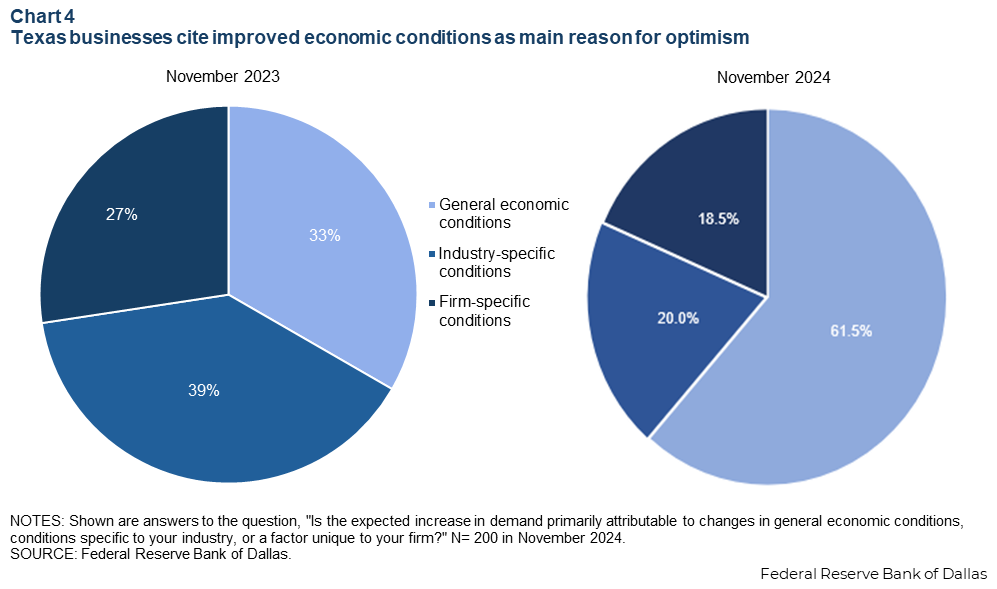

Anticipated improvement in general economic conditions drove the improved outlooks, a change from a year ago, when industry-specific conditions or factors unique to the firm were also primary motivators (Chart 4).

A manufacturer cited a belief that “business will pick back up due to a more pro-business environment,” and a professional services firm indicated “a psychological bump in the economy” since the November election. Contacts’ optimism for faster growth stands in contrast to the Blue Chip and other expert forecasts for 2025 that point to slower growth in the national economy relative to 2024.

Policy changes, potential risks in 2025

The incoming Trump administration has promised deregulation and tax reduction, which businesses generally welcome. However, there are also risks from tariff increases that have been proposed, especially for manufacturing and retail sectors but also involving supply chains and input costs more broadly.

One survey contact noted, “Concerns about potential tariffs on Mexico and China have put a freeze on most plans for expansion and relocation in the manufacturing sector.” A restaurant expressed unease “that any trade war/tariffs could increase our cost of doing business and create supply line interruptions similar to what we experienced during COVID, if not worse.”

Additionally, multiple industries could be affected by stricter immigration policy or mass deportations. A professional association said large-scale deportations “could severely impact the agriculture, construction, hospitality and food manufacturing industries.” A dearth of construction workers paired with tariff-driven raw materials cost increases could limit efforts to expand the housing supply.

Also, large reductions in government spending would adversely affect firms and industries reliant on government contracts as well as the provision of social and health services. A health-care firm expressed concern that, “The election has brought an administration back that already proved detrimental to public services and federal commitment to supporting our most needy.”

About the authors

Emily Kerr is a senior business economist in the Research Department of the Federal Reserve Bank of Dallas.

Ethan Dixon is a research analyst in the Research Department at the Federal Reserve Bank of Dallas.