9.1.20 – Texas Tribune –CASSANDRA POLLOCK

The state collected 5.6% less in sales tax revenue last month than in August 2019. The expiration of some federal relief aid could mean more decreases in coming months

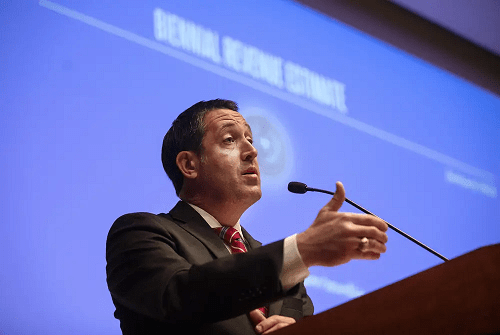

Texas collected about $2.8 billion in state sales tax revenue in August — 5.6% less than in the same month last year, Texas Comptroller Glenn Hegar said Tuesday.

That revenue was based mainly on purchases made in July, when the numbers of coronavirus cases were peaking. That rising rate, the comptroller said, likely put a damper on economic activity.

State sales tax collections from major sectors — except retail trade — declined compared with the same period in 2019, Hegar said. The comptroller said the largest declines happened in sectors related to oil and gas, which includes manufacturing. A Hegar spokesperson also pointed to declines in sectors such as transportation and bars and restaurants.

In retail trade, distance learning prompted higher remittances to the agency from sporting goods, electronics and home furnishing retailers. Consumer spending also increased on home improvements and home entertainment. Such spending, Hegar said, was supported by federal benefits to help offset losses from the pandemic, which have since expired or been reduced.In July, a federal unemployment benefit expired for Texans.

“Consequently,” he said in a news release, “further declines in sales tax revenue may ensue in the coming months.”

Sales tax revenue is the state’s single largest source of funding and feeds into the budget-writing process at the Texas Legislature, which is set to convene for a regular session in January. Since the pandemic hit the state several months ago, sales tax revenue has been mainly on the decline.But there was a slight increase in collections in July compared with the same month in 2019. Still, the state’s total sales tax revenue for June, July and August this year, Hegar said, was down 2.7% compared with the same period in 2019.

Hegar also released totals Tuesday for 2020 fiscal year state revenues, saying that a “surprisingly strong” sales tax collection in July — though “largely reversed in August” — still put yearly revenues ahead of projections his agency made earlier this summer. That fiscal year ended Monday, marking the midpoint of the two-year state budget that lawmakers crafted in the 2019 legislative session.

In July, Hegar revised his revenue estimate, projecting that general revenue available for the state’s current two-year budget would be roughly $11.5 billion less than originally estimated. Hegar also said the state was on track to end the biennium, which runs through August 2021, with a deficit of nearly $4.6 billion.

His revised forecast, he emphasizedat the time, carried “an unprecedented amount of uncertainty” and was based on the assumption that pandemic-related restrictions on the economy would be over by the end of the calendar year, and that economic activity would not bounce back to “pre-pandemic levels by the end of this biennium.” Hegar’s forecast also did not include savings expected from a 5% budget cut that Gov. Greg Abbott and other Republican leaders directed for certain state agencies and higher education institutions for the current biennium.

Other major taxes were also down from the same month last year, Hegar said Tuesday. The hotel occupancy tax, for example, was down 49% from August 2019. And the oil production tax was down 39%.

Disclosure: The Texas Comptroller of Public Accounts has been a financial supporter of The Texas Tribune, a nonprofit, nonpartisan news organization that is funded in part by donations from members, foundations and corporate sponsors. Financial supporters play no role in the Tribune’s journalism. Find a complete list of them here.