8.16.24 – CBS – San Francisco, CA

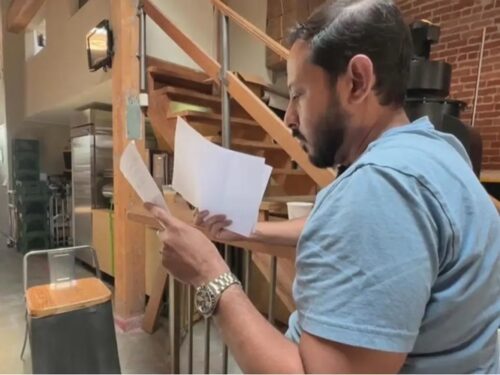

He showed a neighboring business owner evidence of one of multiple break-in attempts he’s had to deal with recently.

San Francisco business owners faced with repeated break-ins say “false alarm” fees being assessed by the city when their burglar alarms sound are adding insult to injury.

Kinani Ahmed sifted through pages of bills in the thousands of dollars for false alarm fees issued by the San Francisco Office of the Treasurer and Tax Collector.

He showed a neighboring business owner evidence of one of multiple break-in attempts he’s had to deal with recently.

“They unlocked this thing and went in. What are they after? There’s nothing,” said Ahmed.

Ahmed founded Sextant Coffee Roasters in SoMa and the Mission ten years ago. He invested and installed higher end security glass to deter would be burglars.The video player is currently playing an ad.

Every time someone tries to break in, his alarm system alerts police. It forces him to make a call as he sees criminals on surveillance video in real-time.

“You go ahead and say ‘dispatch’ and by the time the police respond these guys are already gone,” said Ahmed.

The San Francisco Police Emergency Alarm Ordinance defines a false alarm in part as when the responding officer finds no evidence of a criminal offense or attempted criminal offense.

But Ahmed is frustrated with what he says are fees slapped onto mom-and-pop shops when there’s clear evidence of attempted break-ins.

“Getting fees like this upwards of $3,000 is a lot. It’s a lot for small businesses,” said Ahmed.

Most municipalities including San Francisco have an escalating fee structure for false alarms.

If your alarm is registered, there is no penalty for the first false alarm within the calendar year. The second false alarm penalty is $100, the third is $150, the fourth is $200, and five or more is $250 per instance.

“We need police to be dispatched when somebody tries to get into your business, but you shouldn’t be getting penalized for that,” said Ahmed.

Other business owners have made similar complaints, hoping the city can make it easier to appeal what they feel are legitimate responses to property crimes, but are determined to be false alarms.

“There’s only so much you can take as a business,” said Ahmed.

Mounting fees and other taxes over the years have made him reconsider whether to grind it out or close his doors and join the long list of retailers who have bailed on San Francisco.

“You don’t want to be here but rather go to some other place where you’re appreciated and much more helped by the city,” said Ahmed.

He’s grateful as an immigrant from Ethiopia who has seen success in what was a once thriving small coffee business.

“It can become again what it used to be. We just need to work together and make sure the city hears us and that we feel supported,” said Ahmed.

Ahmed wants to hire more workers and see his business grow. He still believes in the city’s future, but isn’t sure he can keep the doors open.

Data requested of the San Francisco Office of the Treasurer and Tax Collector shows at least 8,200 annual false alarm invoices in 2021-22, 2022-2023, and 2023-2024. But payments applied and fees collected show a steep drop in 2023-2024.

Data for 2021-2022 and 2022-2023 show more than $514,000 collected each fiscal year. However, in 2023-2024, payments applied dropped significantly to less than $260,000.

CBS News Bay Area is waiting for an explanation and response from the San Francisco Office of the Treasurer and Tax Collector for the decline.