(Photo courtesy Divya777/bigstockphoto.com)

1.1.21 – SIW

Policy experts discuss how the change in administrations could affect the market in several key areas

To say that the policies of the Trump administration have had an impact on the security industry would be a massive understatement. While many thought the market would see increased opportunities focused on border security given the president’s hardline stance on immigration and his campaign promise to build a wall along the U.S.-Mexico border, perhaps the most lasting effects of the administration’s policies on the industry have come via its trade actions against China.

Even before the COVID-19 pandemic further soured relations between the two countries, President Donald Trump wielded the power of the Oval Office to slap tariffs on a variety of Chinese goods, including components used in a variety of security technologies. Beyond that, the administration has also taken aim at individual, China-based companies, such as Dahua and Hikvision, and limited their ability to conduct business in the U.S. A provision in the 2019 National Defense Authorization Act (NDAA) specifically prohibits federal agencies from procuring products made by these and several other Chinese manufacturers and even goes so far as to require government contractors to remove products from these companies from their supply chains.

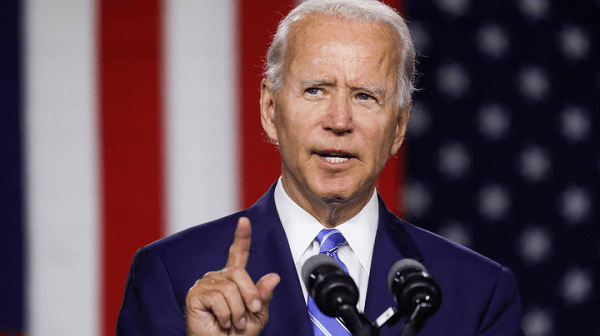

Just last month, President Trump went one step further as he issued an executive order that bars U.S. companies and individuals from investing in Hikvision and other Chinese companies that were previously identified as having links to the Chinese military, a claim that the company adamantly refutes. But as President Trump enters his last few weeks in office, many are now turning their attention to President-elect Joe Biden and what the policies of his incoming administration will mean for the industry.

Besides the approach Biden will take towards China, there are a variety of other security-related issues that policymakers will undoubtedly take up over the next four years that will have wide ranging ramifications for the market. To get a better understanding of what the change in administrations will mean for security firms and professionals alike, SecurityInfoWatch.com (SIW) recently sat down with Jake Parker, Senior Director of Government Relations for the Security Industry Association (SIA), and Howard Schweitzer, the CEO of Cozen O’Connor Public Strategies who also served in high-level political and executive appointments during the Bush, Clinton and Obama administrations, to get their take on what the industry can expect from a policy perspective and how that could impact the industry – both positively and negatively – in the years ahead.

SIW: What are the biggest changes the industry can expect when the Biden administration takes office in January? What moves could the incoming administration make that would have a positive impact on the industry? Conversely, what measures imposed by the new administration or Congress could have a detrimental impact on the market?

Parker: It will take some time to understand and is very much dependent on the people that are appointed in key posts. We will likely see huge shifts within DHS on their priorities. Fortunately, most of the policy issues impact the industry are non-partisan in nature. Large investments in infrastructure have the potential to really boost the security industry, and so much of the government and commercial work is tied to new construction and facility renovation.

There is potential for enactment of a national data privacy law which could have significant impact on how we do business and design products. There is some indication that the administration will be supportive of continued U.S. technology leadership in areas that are key to our industry.

Generally speaking, the Obama-Biden White House took an interest in AI driven innovation. In 2016 it published a report on the current state of AI, its existing and potential applications, and the questions that progress in AI raise for society and public policy. The Obama-Biden Administration asserted that the U.S. must continue to lead in AI innovation, and we are hopeful that the Biden-Harris administration would adopt a similar mindset when addressing these technologies.

Schweitzer: The industry should expect a more robust federal security infrastructure, a reversion to a more traditional and multilateral approach to national security and foreign affairs, and an ever-broadening view of what “security” means, with a heavy emphasis on economic, public health and environmental security.

Once the administration gets the Covid crisis under control, the government will shift its attention to preventing the next pandemic and there will be opportunity there for industry. On the other hand, given the level of government spending – which means, borrowing – to manage the public health and economic consequences of the Covid crisis, spending will be under the microscope for the duration of this administration.

SIW: Do you foresee a continuing crackdown on China-based vendors like we’ve seen under President Trump via the NDAA, blacklist or tariffs?

Parker: Actions targeting this specific group of Chinese companies, most recently in the investment prohibitions announced in President Trump’s executive order last month, are likely to continue. However, with the NDAA Sec. 889 procurement restrictions on specific telecom and video surveillance products now fully in place, any further procurement limitations that are product or company-specific would likely come through the recently established Federal Acquisition Security Council.

Schweitzer: China is the rare issue in Washington where there’s little daylight between the Republicans and Democrats. It is not politically palatable for Biden to be seen as weakening on China, so we largely expect the Trump trade policies to be carried forward. On the other hand, Biden will seek concessions from China on climate policy and human rights, so there will be horse trading to be done as the administration matures.

SIW: Given the anticipated shift away from border security and immigration that we saw ramped up under Trump, what effects do you think that will have on the industry? Do you see those resources being shifted to other security projects?

Parker: Hopefully, we will see the focus on physical barriers from the current administration replaced with a renewed emphasis on implementing technologies that provide greater situational awareness on the U.S. border, between ports of entry. At the same time this is not a market driver for much of the security industry.

Schweitzer: The rhetoric will be very different, but Biden isn’t suddenly going to open our borders.

SIW: Do you foresee any changes to the government procurement/contracting process under new leadership?

Parker: 2020 has been a year of tremendous change in contracting, with consolidation of all GSA multiple award schedule contracts into one. The third phase of this consolidation will be completed in 2021. Also, in August this year GSA’s new commercial platform for procurement under the micro-purchase threshold ($10,000) was launched, in partnership with Amazon, Overstock.com and some others. One thing the industry is watching is to what extent the platform will draw sales away from the schedules program and the impact that will have for end-users and suppliers of electronic security products. There will potentially be a new GSA head to replace Emily Murphy, however, incoming administrations often stick at least initially with the current person in that position as GSA appointees tend to be career GSA versus more political.

Schweitzer: I don’t expect major changes regarding procurement, other than an emphasis on depoliticization of the process.

SIW: Do you think we will get more clarity on several issues that the previous Congress has overlooked, namely facial recognition and data privacy regulations?

Parker: How much shift we see in the status quo really depends on the outcome in the Senate, where divided government would likely prevent enactment of extreme legislation on these or a host of other issues. At the same time, industry is supportive of reasonable regulations on facial recognition and approaches to data privacy that create nationwide, versus state by state, rules on data privacy. Progress under divided government will depend on whether the right balance can be struck on those issues.

Schweitzer: Privacy remains one of the top policy issues cutting across all levels of government. I expect Congress to continue to try to address these issues, although in many ways, regulating privacy is an attempt rein in Big Tech and the government has other tools to accomplish that big picture policy objective.

SIW: What kind of impact could a reversal of the Trump tax cuts that Biden has promised have on the industry?

Parker: Small businesses in the industry would be negatively impacted by the increase in marginal tax rates, elimination of the 20 percent small business income deduction, and lifting of caps on payroll taxes. Corporations would see the current 21% flat rate jump to 28%. It’s not clear whether rollbacks of other business tax provisions for the Tax Cuts and Jobs Act would be on the table, but they could be at risk. SIA worked with other industry organizations in 2017 to ensure the law included an expansion of “Section 179 expensing” to roofs; heating, ventilation and air-conditioning (HVAC); fire protection and alarm systems; and security systems. Again however, sweeping change in unlikely if Republicans hold the Senate after the January runoffs in Georgia.

Schweitzer: Changes in tax policy are entirely dependent on the Georgia Senate race outcomes but if they were to occur, they would hurt companies across the entire economy, security included.

Joel Griffin is the Editor-in-Chief of SecurityInfoWatch.com and a veteran security journalist. You can reach him at joel@securityinfowatch.com.