1.1.22 – WAFB9 – BATON ROUGE (AP) —

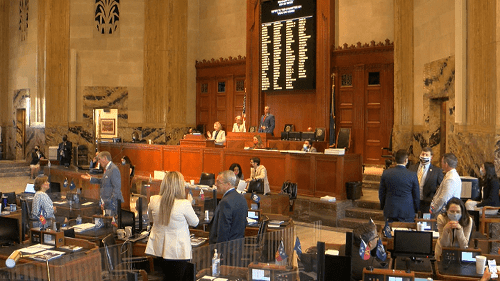

Most of the new laws taking effect Saturday were passed by the state legislature last June

Louisiana’s medical marijuana program will offer raw, smokable cannabis to its patients, and the state will tweak its calculations for state income taxes as more than two dozen new laws take effect on New Year’s Day.

Most of the new laws taking effect Saturday were passed in the regular legislative session that lawmakers wrapped up in June. Voters approved the income tax changes in the fall, after lawmakers sent the measure to the ballot for consideration.

Among the new laws:

MEDICAL MARIJUANA

The expansion of Louisiana’s medical marijuana program under the law sponsored by Houma Rep. Tanner Magee, the House’s second-ranking Republican, is expected to offer state residents a cheaper form of cannabis to treat their medical conditions.

The state’s dispensaries have been selling medical marijuana in liquids, topical applications, inhalers and edible gummies. The legislation taking effect in January adds raw marijuana in smokable form to that list of products already available for sale. Because it involves less processing, raw marijuana is anticipated to be less expensive for patients.

Lawmakers have steadily widened the rules for Louisiana’s medical marijuana program since enacting the dispensing framework in 2015.

INCOME TAX CHANGES

Louisiana taxpayers will see changes to their income tax rates and deductions in taxable periods that start in 2022, under a package of bills passed by the Legislature and approved by voters when they agreed in the November election to the constitutional changes involved.

The changes will get rid of personal income tax and corporate tax deductions for federal income taxes paid, in exchange for lowering income tax rates. Most excess itemized deductions taken by middle- and upper-income earners will disappear.

An economic analysis of the changes — done by the nonpartisan Legislative Fiscal Office — said most individual income taxpayers who don’t itemize will see a tax cut. Those who itemize likely will pay more. The office estimated fewer than 2 percent of those who file corporate taxes will see tax bills rise.

The tax changes may not be obvious until people file their tax returns for the 2022 year.

OTHER NEW LAWS

Among other new provisions taking effect are tax credits and deductions available to families after the delivery of a stillborn child, for funeral and burial expenses associated with a pregnancy-related death and for adopting a child from foster care.

Meanwhile, certain training policies required by lawmakers to combat police misconduct in Louisiana kick in Saturday. Also, law enforcement agencies must have in place detailed policies for when body cameras and dash cameras must be turned on by officers who have them.