3.11.21 – WBOC –

State Comptroller Peter Franchot said Thursday that he is extending the filing deadline to July 15 because recent and pending state and federal COVID-19 relief legislation also affects 2020 tax filings.

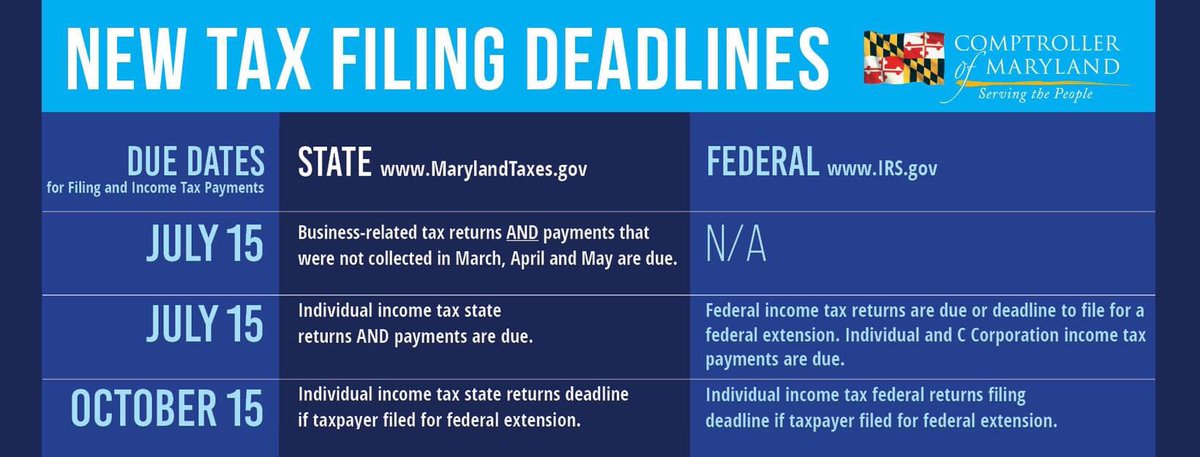

Using statutory authority granted to him, Maryland Comptroller Peter Franchot announced Thursday that he is extending the state income tax filing deadline by three months until July 15, 2021. No interest or penalties will be assessed if returns are filed and taxes owed are paid by the new deadline.

The extension, which applies to individual, pass-through, fiduciary and corporate income tax returns, including first and second quarter estimated payments, is due to recent and pending legislation at the state and federal levels that impact 2020 tax filings and provide economic relief for taxpayers harmed by the COVID19 pandemic.

In Maryland, passage of the RELIEF Act in February required extensive revisions to previously released forms and software programs used by tax filers and tax software vendors. Legislative veto overrides that took place later than usual prompted additional changes. At the federal level, the passage of a third stimulus package this week necessitates more changes to federal and state forms even as the traditional April 15 tax filing deadline approaches.

“We’ve never before seen so many changes to the current year’s tax code in the midst of the tax filing season,” Franchot said. “We’re realistic about the burden this puts on taxpayers, tax preparers and our staff, which is why I’m taking this emergency action to extend the tax filing deadline to July 15.”

As of now, the Internal Revenue Service has kept its filing and payment deadline at April 15. The Comptroller’s Office will notify taxpayers if the IRS makes any adjustments.

Taxpayers who already have filed their state returns and are awaiting the revision of forms to amend their taxes to take advantage of an Unemployment Insurance subtraction should remain patient. The third federal stimulus bill provides additional Unemployment Insurance (“UI”) tax benefits, which requires more updates to both state and federal forms. Taxpayers who intend to take advantage of the UI subtractions are advised to wait until April 15, when all state forms will be ready with federal and state legislative changes.

“I know many Marylanders are eager to take advantage of these relief programs that will put more money back in their pocket and our agency is working as fast as possible to make the necessary changes,” Franchot said. “Our goal is to streamline this process so taxpayers don’t have to file multiple amendments as a result of further federal changes.”

Franchot noted that revisions to tax forms usually take several months and occur before the start of tax season. The multiple extensive changes in the midst of the tax season is unprecedented, he noted.

Additionally, Franchot is extending the due date of the Tobacco Floor Tax payment from June 13, 2021 to July 15, 2021. This floor tax was established by the veto override of House Bill 732 from the 2020 legislative session and the pending passage of Senate Bill 787 from the current session. Tobacco inventory must be taken after the close of business on March 13, 2021, but the Comptroller is granting taxpayers additional time to remit the floor tax.

Further, due to changes included in the RELIEF Act and the veto override of House Bill 932 from the 2020 session, the deadline for Sales and Use Tax returns also has been revised. Any SUT returns for sales taking place in March, April and May of 2021 will now be due on July 15, 2021.

Affected tax filers will automatically receive this extension and no interest or penalties will be assessed if returns are filed and taxes owed are paid by July 15.

One key provision of the RELIEF Act expanded the state’s Earned Income Tax Credit for the next three years so that claimants get a larger refund and separate legislation extends eligibility to taxpayers using Individual Tax Identification Numbers (ITINs). On April 1st, the comptroller’s website will launch a new EITC calculator tool for eligible taxpayers to determine how much they can expect to receive from this enhanced benefit.

Those who claim the Earned Income Tax Credit, which is designed to benefit low-to-moderate income working taxpayers, will have the adjustments automatically made to their filings. For taxpayers who already have submitted their returns, those refunds will begin to be processed on April 15 with no further action required by the taxpayer.

The Comptroller’s Office will notify the public about the availability of revised and new tax forms on its website and social media accounts. Additional information on tax forms and other RELIEF Act updates can be found at https://www.marylandtaxes.gov/RELIEFAct. Taxpayers with questions about RELIEF Act provisions should email ReliefAct@marylandtaxes.gov. Those with general tax inquiries should email taxhelp@marylandtaxes.gov.