1.6.20 – Baltimore Business Journal – By Holden Wilen – Reporter, Baltimore Business Journal

Maryland Comptroller Peter Franchot announced Wednesday that his office is deferring certain taxes for 90 days to help small businesses stay afloat and stimulate the local economy.

Many small businesses and families across Maryland continue to struggle as the number of Covid-19 cases soars and the rollout of vaccines remains sluggish. By delaying collection of taxes, Franchot said businesses will receive what amounts to between $1 billion and $1.5 billion in “immediate and temporary relief.”

The deadline for business taxes and quarterly estimated income tax returns and payments that would be due in January, February and March has been extended to April 15. No interest or penalties will be assessed and businesses do not need to file a request for extension.

Franchot, a Democrat who has already announced he will be running for governor in 2022, took similar action last year during the early stages of the pandemic. He had been considering repeating the move again in recent weeks and made it official Wednesday at a meeting of the Board of Public Works.

“Here in Annapolis in the coming weeks and days and months, I think we need to do more, not less, to help our small businesses and individuals,” Franchot said. “I’m going to practice what I preach.”

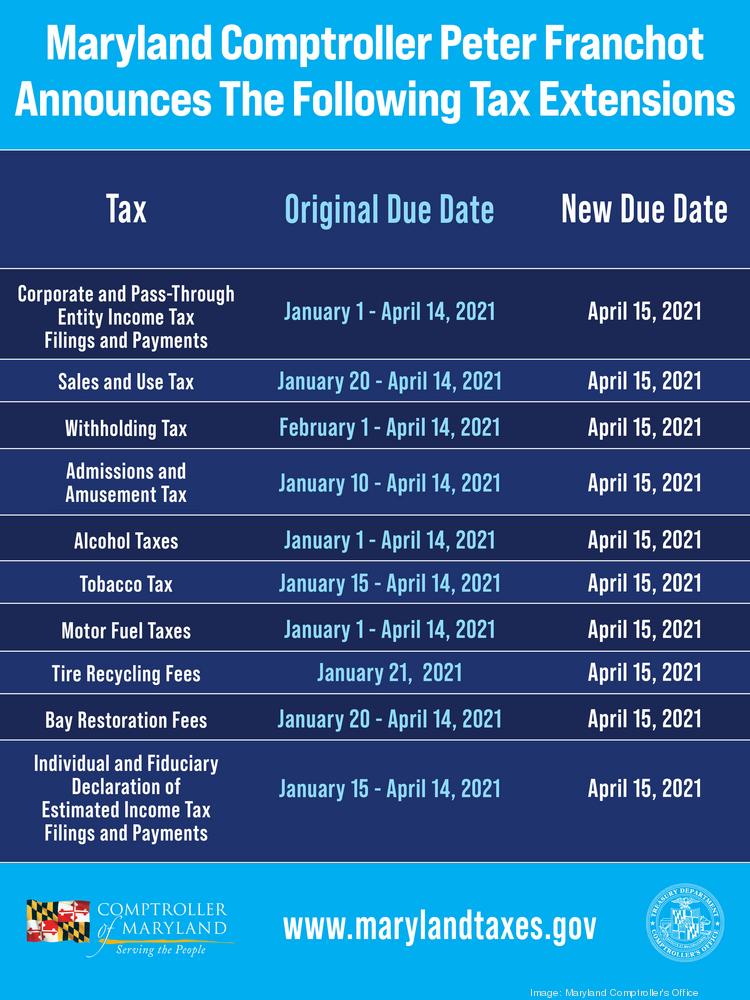

The extension applies to business taxes administered by the comptroller: sales and use, admissions and amusement, alcohol, tobacco and motor fuel, as well as tire recycling and bay restoration fee returns and payments with due dates between Jan. 1 and April 14. Businesses and self-employed individuals or independent contractors with estimated income tax returns and payments due on Jan. 15 will also be granted an extension until April 15.

“You’re going to have to pay your tax, but we’re giving you a 90-day interest-free, penalty-free loan from the state of Maryland,” Franchot said.

Here’s a full breakdown of the new tax deadlines, provided by the Comptroller’s Office.

Franchot also again called on Gov. Larry Hogan to provide more relief to small businesses and individuals. He recommends using money from the state’s rainy day fund and the surplus general fund balance from the previous fiscal year that ended June 30. He said the state should also consider providing $2,000 stimulus checks to all Marylanders.

“We need to get money in people’s pockets so that they can avoid suffering and use that money to lubricate the economy,” Franchot said. “The more money that we put in with these stimulus plans, the quicker and faster the economic recovery will be.”

In terms of tax relief, employers must complete their 2020 withholding tax returns and payments due by Jan. 31 to ensure that W-2s will be delivered on time for taxpayers to file when the tax season begins at the end of the month. Any state withholding returns and payments originally due between Feb. 1 and April 14 may be submitted by April 15 without incurring interest and penalties.

Employers must still file and pay federal withholding taxes. Franchot sent a letter to the Internal Revenue Service requesting the same forbearance period for federal monthly business tax payments as his office provided.

“I believe this will be the most immediate and effective remedy for American businesses and consequently its citizens that we can take at this juncture,” Franchot wrote in the letter. “This same action helped countless millions last year and can do so again. Americans need decisive action now more than ever.”