Maryland business groups celebrated a major victory Thursday after a House of Delegates subcommittee voted unanimously to kill a proposed new tax that would have raised prices for professional service providers including hairdressers, real estate agents, architects and lobbyists.

The bill, which sparked an intense lobbying battle, proposed slapping a new 5% sales tax on professional services, while lowering Maryland sales tax on goods from a percentage point to 5%. As the state scrambles for money funds for improving public education, an analysis estimated the new tax could generate a net $2.9 billion per year by 2025.

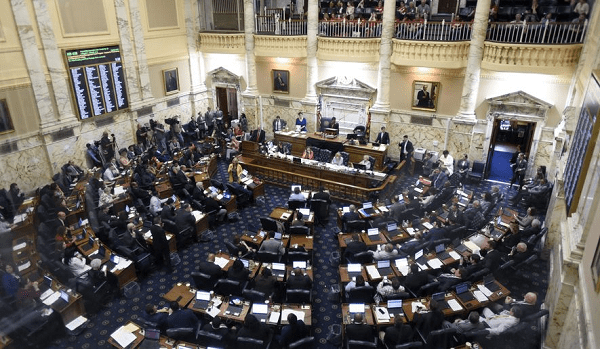

However, lawmakers on a House Ways and Means subcommittee late Wednesday night decided to drop the idea after the tax bill faced powerful opposition from a number of service organizations and Republican Gov. Larry Hogan.

Harford County Association of Realtors CEO Kathy McFadden, whose members rallied in Annapolis against the new tax before Wednesday’s vote, said the state’s real estate industry already pays $9 billion worth in taxes to the state annually.

“We’re not against any education,” Ms. McFadden said. “It’s just that, as the real estate industry, we feel we’ve paid our fair share of taxes.”

Ms. McFadden added, “Schools are very important for the housing industry because a lot of people want to be in the best schools, and in order to have the best schools, we have to have the funding for those schools.”

Business groups said the service tax vote was a test of the state’s reputation as a business-friendly state. Many say Maryland suffers in comparison to regional rivals, especially Virginia, in establishing the business and tax climate to attract companies looking to expand.