6.13.20 – Shreveport Times

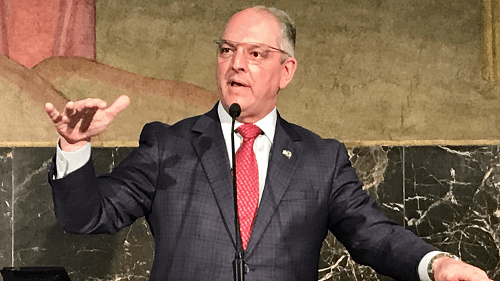

BATON ROUGE — Gov. John Bel Edwards on Friday vetoed eight bills passed by Louisiana lawmakers in their recently ended regular session, including the business lobby’s top priority, a measure to scale back damage claims against insurance companies in car accident lawsuits.

In rejecting the sweeping changes to Louisiana’s civil litigation system, the Democratic governor said the bill by Republican Sen. Kirk Talbot of River Ridge didn’t contain a commitment that it would lower insurance rates as its supporters promised.

“It is important to note that not a single insurance company testified in committee that (the bill) would actually reduce rates,” Edwards wrote in his veto message, released Friday evening. “Further, the rate reduction provision in the bill is permissive, rather than mandatory, and actually allows for rate increases if the insurers are able to demonstrate one would be needed.”

GOP lawmakers are trying to pass a similar measure in the Legislature’s ongoing special session, and Edwards said he’s willing to continue negotiations.

“I remain willing to work with anyone operating in good faith to reach a compromise,” Edwards wrote.

Edwards also scrapped bills that would have given lawmakers more oversight of state contracts and would have enacted new restrictions on TV, radio and billboard ads from lawyers promising big paydays by suing businesses.

He jettisoned a measure that would have expanded an existing law barring entrance to any place deemed “critical infrastructure,” such as chemical plants, power plants, water treatment facilities, ports and pipelines. The bill by Republican Rep. Jerome “Zee” Zeringue of Houma would have added floodgates and pump stations to that list — and would have toughened the penalties during states of emergency, requiring a mandatory minimum three-year prison sentence for anyone convicted.

At the Louisiana Capitol, the veto drawing the most interest involved the so-called tort reform bill changing the system for handling car wreck lawsuits, a measure championed by business groups.

The measure would have forced jury trials more frequently, so that lawyers would have to argue damage claims to more people than a single judge; capped certain damages that can be awarded; limited when insurance companies can be sued directly; and increased the time accident victims can file lawsuits to give more time for settlement negotiations. It also would have allowed information about whether someone was wearing a seat belt as evidence in litigation.Get the Storm Watch newsletter in your inbox.

Latest news updates during the emergency.Delivery: VariesYour Email

Supporters of the measure said it will lower Louisiana’s car insurance rates, which are the nation’s second-highest, by making it less lucrative to sue over car accidents.

But in the flurry of final rewrites to the legislation amid negotiations with the Edwards administration, lawmakers added language that could cause even larger damage awards in some of those lawsuits. Republican lawmakers who backed the proposal urged Edwards to sign the bill and work with lawmakers on the language fix.

“The governor’s veto of Sen. Talbot’s (bill), the bill to reduce frivolous lawsuits and insurance rates, was not unexpected, but make no mistake, leaving this special session without legislation signed into law to address the insurance crisis is not a feasible option. Everyone knows the insurance affordability and availability problem is very real,” Stephen Waguespack, president of the Louisiana Association of Business and Industry, said in a statement.

Opponents of the package of civil litigation system changes, largely lawyers and Democrats, argued the measure would keep people from getting money needed to cover their medical bills and could increase costs for courts.

Bill backers worry that Edwards won’t sign any version of the bill because his allies and campaign contributors include personal injury lawyers