5.14.20 – CEPro – For More Info

CEDIA COVID-19 Study reveals business fell for 85% of integrators with most projects delayed 1 to 3 months. Paying bills and staff safety are top concerns.

Confirming with hard data what many in the industry already knew anecdotally, CEDIA has revealed the findings of its COVID-19 Impact Study and the numbers are not pretty. Like most other businesses around the world, custom integrators in the U.S., Canada and U.K. are experiencing lower revenues, concerned about paying their bills, and worried about the safety of their staffs.

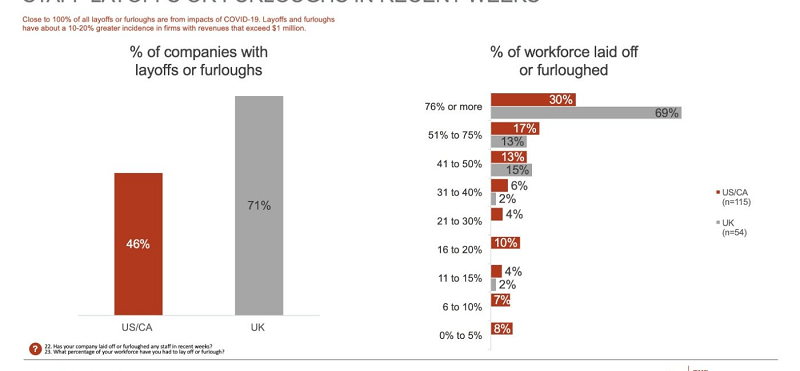

Moreover, new sales that are occurring during the coronavirus pandemic are at lower price points on average. Nearly half (46%) of U.S. and Canadian integrators have either laid off or furloughed staff, and among those that have trimmed their staff numbers, the majority have let go more than half of their employees.

The survey was conducted by The Farnsworth Group from April 13-28 and had 344 worldwide respondents. In general, integrators in the U.K. are faring worse than those in America.

“It is not a big shock that there is a large negative impact on how COVID-19 has impacted businesses,” says Grant Farnsworth, director of business strategy and managing partner at The Farnsworth Group. He was joined by James Bliss, CEDIA EMEA Brand and Communications Manager for a webcast to dig deeper into the data.

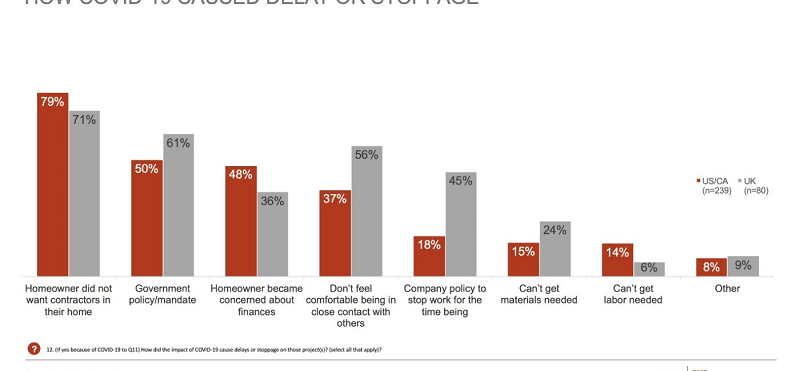

About 90% of system integrators reported they are doing less work because of COVID-19 with the top reasons being homeowners not wanting contractors in their homes, government mandates, homeowner finances, and person discomfort being in close contact with others. Most integrators are currently expecting project delays to last about 1 to 3 months.

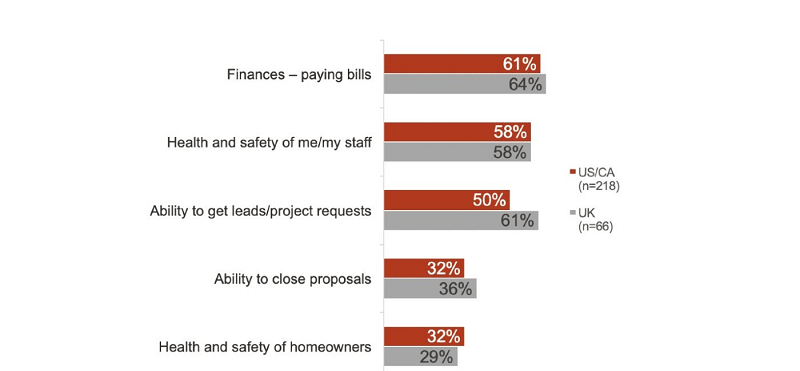

Most companies have experienced or plan to implement layoffs or furloughs. Nearly all integrators are concerned for the future of their business, with about half stating extreme concern primarily due to the ability to pay bills, the health of their staff, and the ability to get project requests.

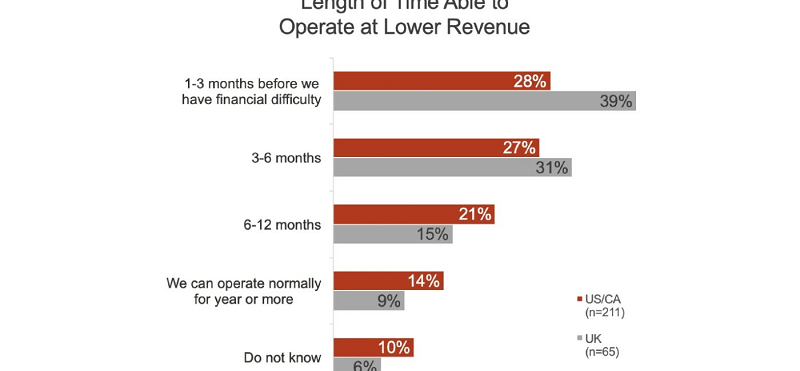

Most integrators expect revenue to be less, with about half of integrators expecting much less revenue. Most integrators expect to be able to operate their business at these lower revenue levels for maximum of 3 to 6 months.

In general, smaller integration companies are in a more dire situation than larger firms, says Farnsworth. “The larger the firm, the more likely they are to stay financially stable during this crisis,” he points out.

Bliss notes that the primary reason for the U.K. dealer community being hit so much harder has to do with the national policy in Great Britain compared to the state-by-state restrictions in the U.S.

Looking forward, Farnsworth says there is no way to predict the future.

Positive Signals from the Data

On the bright side, integrators report a surge in home network installations since the coronavirus hit. The data show that 8% of integrators say their home network projects are up significantly, and another 30% say that subsystem business has increased slightly. Another 25% of integrators report their home network installation business has remained unchanged since before the lockdown. This trend clearly points to the growth in home offices and the reliance homeowners have on their Internet connections while stuck at home.

Another positive signal from the data is that the worst appears to be over. Farnsworth tracks weekly data across the entire home construction industry and the impacts appear to be lessening.

“We are starting to see the severity of the negative impact slightly decline,” he says. “It appears that the end of April is when the market bottomed out. We are starting to see signs of life.”

CEDIA Study: Coronavirus Data Is Ugly

Some of key data points for U.S. integrators from the study are:

- 72% of integrators are experiencing fewer bids.

- 50% of custom installers have seen their average system price drop.

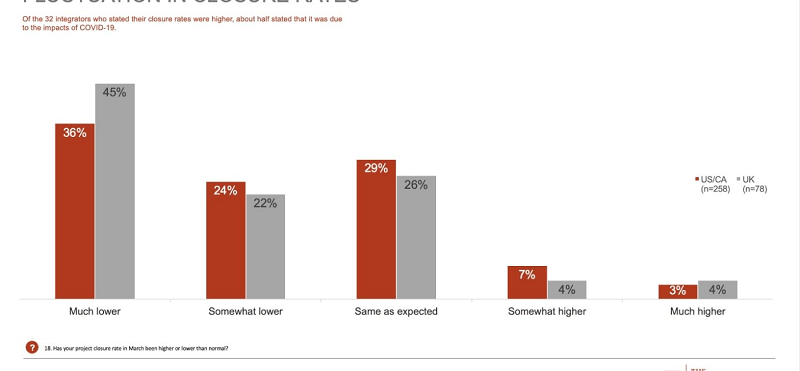

- 62% of integrators have seen their closing rate drop.

- 77% of integrators report that business has slowed because homeowners do not want them in their homes, while 45% of integrators said projects were delayed because the homeowners are concerned about finances. Interestingly, 37% of integrators said the reason that business has slowed is because they have concerns for their own safety to enter a client’s home… so the fear of the virus is on both sides of the equation with homeowners and dealers.

- 85% of integrators expect lower revenues in 2020.

- 30% of projects are delayed between one and three months, another 28% of jobs have been pushed back three to six months, and 20% of projects are now delayed between six and 12 months.

- 54% of integrators said COVID-19 was a “big negative” on their business, but 2% of integrators said the crisis has benefitted their business. Those are likely integrators who have found a niche in growing areas like wellness or security.

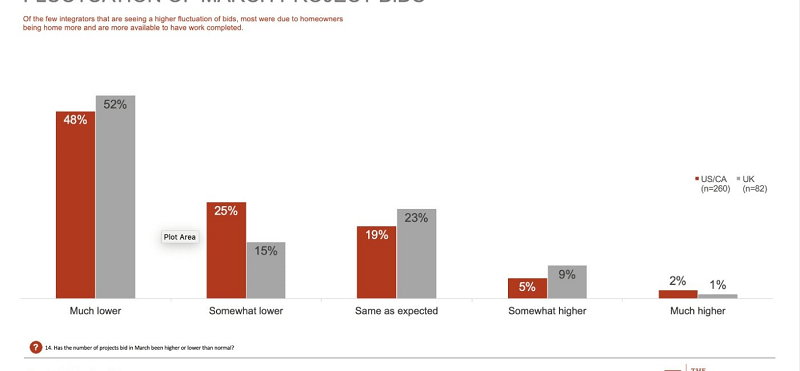

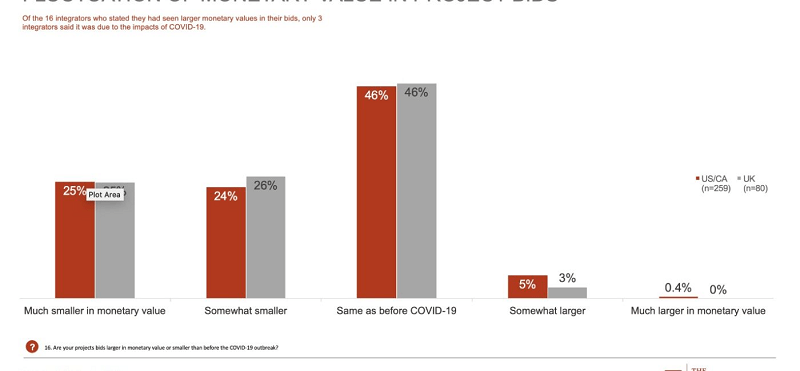

- In terms of future proposals, 48% of integrators say those bids are “much lower.”

- In total, nearly half (49%) of all proposals are for less money than before the lockdowns hit; however, 46% of integrators say their average proposal prices have not changed, and 5% have actually experienced a jump in their average job size.

- Commercial work has also slowed, with 64% of dealers saying their requests for commercial project proposals are either “much lower” or “somewhat lower.”

- 46% of integrators have either laid off or furloughed staff. Among those companies, nearly half (47%) have either laid off or furloughed more than half of their employees.

- 9% of integrators say they are likely to lay off or furlough even more employees in the coming weeks.

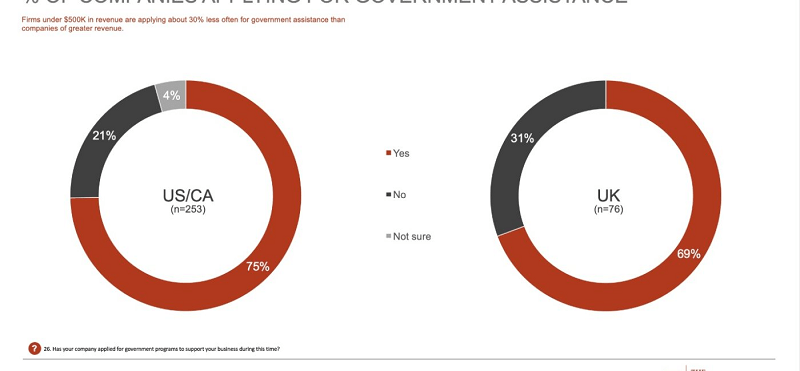

- 75% of U.S. integrators have applied for government assistance during the crisis.

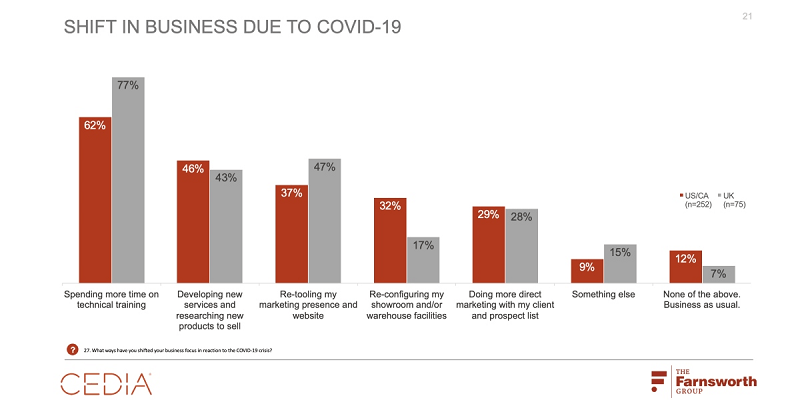

- During the downtime, dealers are spending time training staff (62%), researching new products or niche markets (46%), sprucing up their marketing presence and website (37%), reconfiguring their showrooms or warehouses (32%), or increasing their marketing (29%).

- 96% of integrators are either “extremely concerned” or “somewhat concerned” about the future of their business.

- 61% are most concerned about paying their bills.

- 58% are concerned about the safety of their staff.

- 32% are concerned about the safety of their clients.

Closure Rates

Caused Delay or Stoppage

Number of Bids

Layoffs or Furloughs

Government Assistance

Monetary Value of Bids

Top Concerns

Length of Time to Operate at Lower Revenue

ABOUT THE AUTHOR

Follow

Follow

Jason Knott:

Jason Knott is Chief Content Officer for Emerald Expositions Connected Brands. Jason has covered low-voltage electronics as an editor since 1990, serving as editor and publisher of Security Sales & Integration. He joined CE Pro in 2000 and serves as Editor-in-Chief of that brand. He served as chairman of the Security Industry Association’s Education Committee from 2000-2004 and sat on the board of that association from 1998-2002. He is also a former board member of the Alarm Industry Research and Educational Foundation. He has been a member of the CEDIA Business Working Group since 2010. Jason graduated from the University of Southern California.

View Jason Knott’s complete profile

When asked how long they can operate their businesses before reaching a point of serious financial strain, CEDIA’s audience reported that 76% of their businesses will face financial hardship by the 1-year mark.