11.15.24 – Oklahoma City Sentinel

The U.S. housing market remains a critical economic issue, with housing affordability and supply at the forefront of bipartisan policy agendas. Both Republican and Democratic lawmakers are increasingly focused on expanding access to affordable housing and addressing the nationwide housing shortage. According to a recent Zillow analysis, the U.S. faces a shortfall of 4.5 million housing units, a deficit that continues to drive high prices for both homeowners and renters.

Expanding multi-family housing—such as townhomes, condos, and apartments—offers one of the most effective solutions for addressing this shortage and improving affordability. Multi-family developments allow for higher housing density in urban and suburban areas and are generally more cost-efficient to build than single-family homes, making them a faster and cheaper way to increase supply. However, restrictive zoning regulations in many areas have historically made it difficult or even impossible to construct multi-family housing.

Recently, though, there has been growing political momentum to relax or eliminate these zoning restrictions, among other barriers to new home construction. And as such, higher-density housing is on the rise.

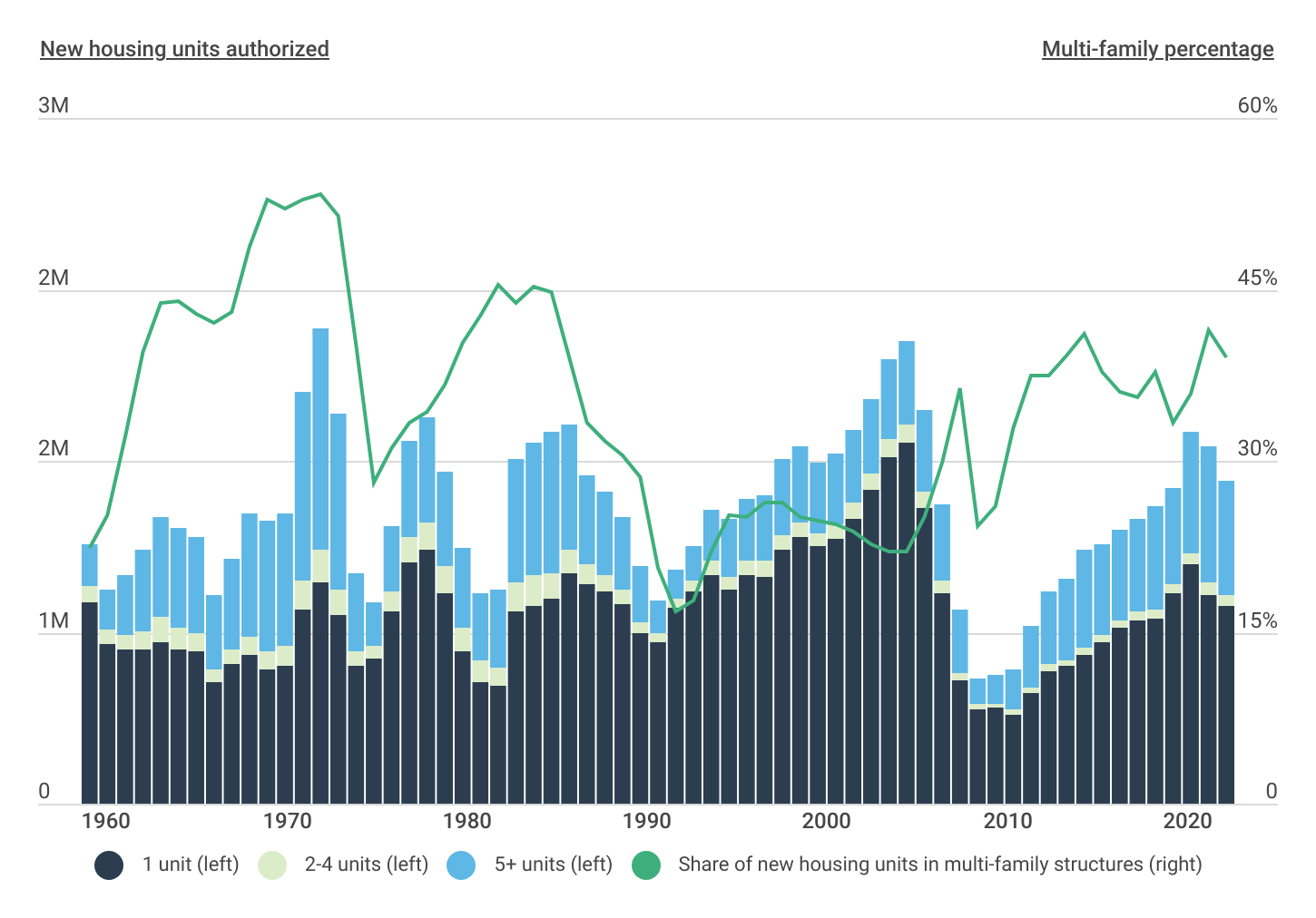

New Home Construction by Unit Type

Multi-family units account for a growing proportion of new construction

Source: Construction Coverage analysis of U.S. Census Bureau American data | Image Credit: Construction Coverage

During the lead-up to the 2000s housing bubble, loose lending standards and easy access to mortgages fueled demand for larger, single-family homes. Between the mid-1990s and mid-2000s, only about a quarter of new homes built in the U.S. were multi-family units, as Americans largely favored the suburbs. However, after the 2008 market collapse, housing construction slowed dramatically, just as millennials were reaching adulthood and showing a growing preference for urban living. This shift contributed to an urban revival, where demand for higher-density housing began to rise.

As a result, the limited construction that continued in the years following the crash increasingly focused on multi-family developments. Between 2009 and 2023, the share of new housing authorized that were multi-family units rose from 24.3% to 39.1%. Whereas in 2009 the U.S. built just over 141,000 new multi-family units, in 2023 the number was over 591,000.

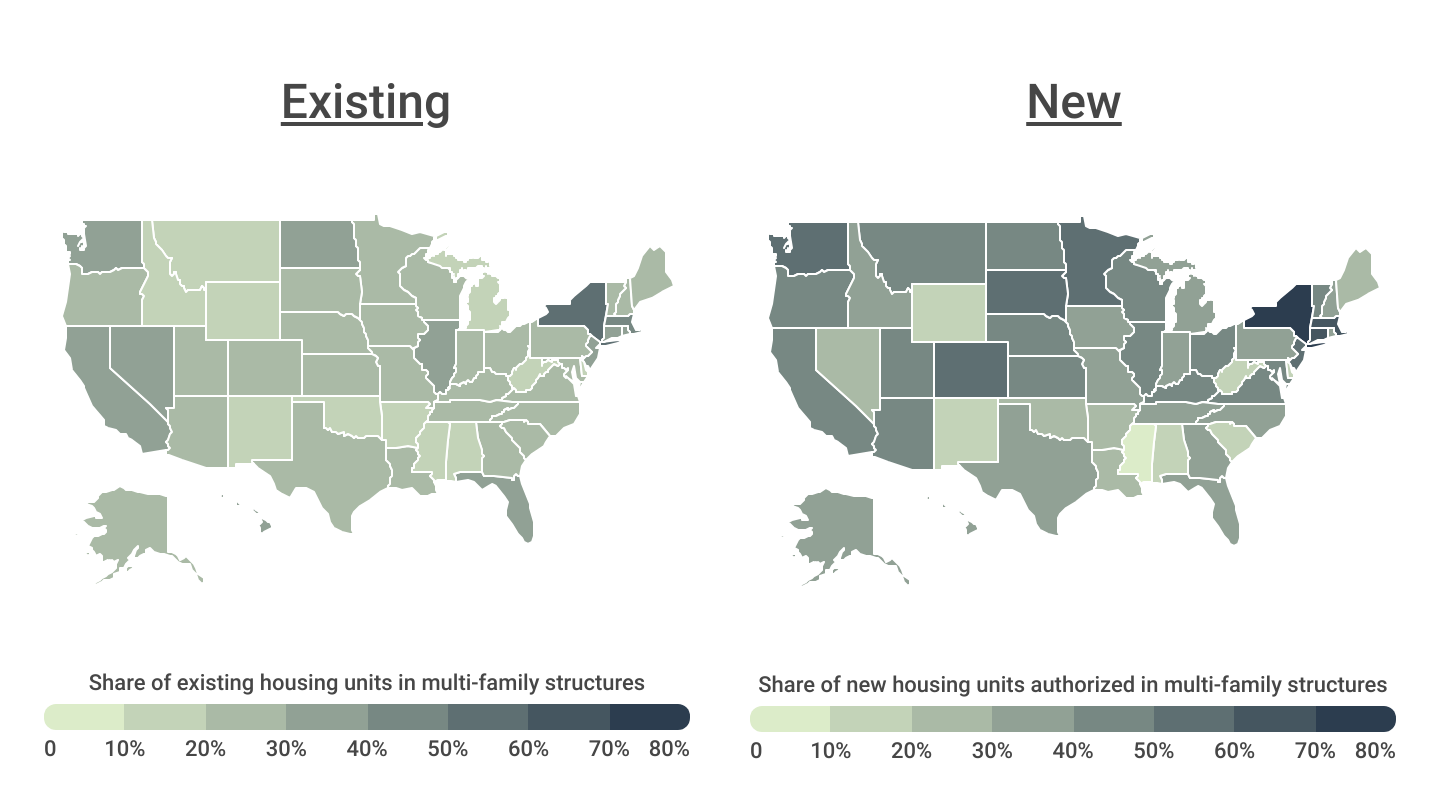

Regional Differences in Multi-Family Housing

All but 8 states are building more multi-family housing now than in the past

Source: Construction Coverage analysis of U.S. Census Bureau American data | Image Credit: Construction Coverage

Nationally, about 29% of the existing housing stock consists of multi-family units, though this varies significantly across regions. New York leads the nation, with 52.7% of its existing housing classified as multi-family, followed by Massachusetts (43.2%), Rhode Island (39.9%), Hawaii (37.2%), and New Jersey (36.8%). In contrast, states in the South, Midwest, and Mountain West—with more space and larger rural populations—historically invested less in medium- and high-density housing. States like West Virginia, Idaho, Mississippi, and Wyoming have less than 17% of their housing stock composed of multi-family units.

When considering newly built housing units, a few notable trends stand out. States with traditionally high levels of multi-family housing, such as New York, Connecticut, and Massachusetts, continue to prioritize this type of development. In these states, multi-family units accounted for over 60% of all new authorizations in 2023, with New York leading at over 80%. In fact, in all but eight states, the percentage of new housing units categorized as multi-family exceeded that of the existing housing stock last year.

Perhaps most interesting, there has been a surge in multi-family home construction in unexpected regions. States in the Midwest and West—historically characterized by lower concentrations of multi-family units—are now embracing denser housing. In South Dakota, Washington, Minnesota, and Colorado, more than half of new home construction was multi-family last year.

Similar patterns emerge at the local level, where a blend of densely populated coastal cities and focal points in the Midwest and Western United States show the highest rates of multi-family development. There are a few exceptions, but generally, cities in the South report the lowest rates of new multi-family housing. This is likely attributed to lower demand and lower home prices compared to other regions of the country.

The analysis was conducted by Construction Coverage, a platform for comparing construction insurance, using data from the U.S. Census Bureau. Researchers calculated the share of new privately-owned housing units authorized by building permits in multi-family structures (two or more units) in 2023.

Here is a summary of the data for Oklahoma:

- Share of new housing units authorized in multi-family structures: 23.0%

- Share of existing housing units in multi-family structures: 18.7%

- Total new housing units authorized in multi-family structures: 3,080

- Total new single-family units: 10,325

- Total new housing units in structures with 2 units: 780

- Total new housing units in structures with 3–4 units: 325

- Total new housing units in structures with 5+ units: 1,975

For reference, here are the statistics for the entire United States:

- Share of new housing units authorized in multi-family structures: 39.1%

- Share of existing housing units in multi-family structures: 28.6%

- Total new housing units authorized in multi-family structures: 591,129

- Total new single-family units: 919,973

- Total new housing units in structures with 2 units: 34,224

- Total new housing units in structures with 3–4 units: 20,492

- Total new housing units in structures with 5+ units: 536,413

For more information, a detailed methodology, and complete results, see U.S. Cities Building the Most Multi-Family Housing on Construction Coverage.

Originally published on constructioncoverage.com, part of the BLOX Digital Content Exchange.