5.6.21 – Commercial Appeal – Randy Hutchinson is the president of the Better Business Bureau of the Mid-South. Reach the BBB at 800-222-8754.

I frequently write about FTC settlements with companies accused of deceptive sales practices. Few have been as ugly as one it just reached with Vivint Smart Home.

My first reaction was the company’s actions sounded like a smaller scale version of the Wells Fargo fake accounts scandal. Lo and behold, FTC Commissioner Rohit Chopra made the same comparison in a statement about the case.

Vivint is one of the largest home security and monitoring companies, with more than 1.5 million customers. It employs door-to-door salespeople, many working during the summer on a commission-only basis. Vivint’s system typically costs $1,000 or more and many customers finance the purchase. Salespeople use a proprietary system to check credit records and complete the sale.

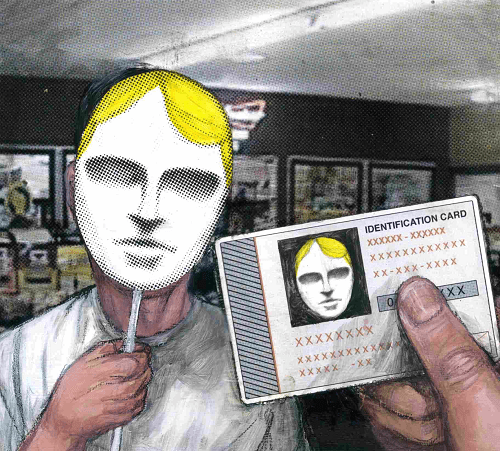

If a prospective customer didn’t qualify for the loan, some Vivint salespeople committed two illegal forms of identity theft to make the sale. The first was called “white paging,” in which the salesperson would find an unrelated person with the same or a similar name in the white pages and use that person’s credit history to approve the unqualified

In the second form of identity theft, the salesperson would ask the customer for the name of someone the customer knew had better credit and add that person as a cosigner on the account without the person’s knowledge.

If the unqualified customer defaulted on the loan, Vivint referred the innocent party to a debt collector. The delinquent loan was also reported to the credit reporting agencies, damaging the person’s credit record.

The FTC alleged that Vivint knew about the deceptive practices of salespeople and terminated many offenders, only to rehire some later. Commissioner Chopra suggested that Vivint’s management may have turned a blind eye to the scam in order to pump up sales to achieve a higher valuation in a public offering.

An FTC attorney noted the irony of a company engaging in identity deception to sell products that help residents ensure people at their door are who they say they are.

Vivint will pay $20 million to settle charges it violated the Fair Credit Reporting Act, the FTC Act and other regulations. It’s not the only time Vivint has run afoul of federal and state regulators.

Vivint is headquartered in Utah and has an F record with the BBB there. Over 4,600 complaints have been filed against the company in the past three years, including sixty from Mid-Southerners.

None involved the kinds of identity theft described in the FTC settlement, although one consumer complained that his credit report was pulled even though he told the salesperson he was not ready to sign or purchase anything.

Some complaints allege common misleading tactics in the door-to-door sale of alarm systems. They include misrepresentation about the full cost of the system, false promises to buy out existing alarm system contracts, and loans opened in customers’ names without their knowledge.

In its responses, Vivint often pointed to calls made before the installation to confirm the customer understood the terms.

Don’t succumb to high-pressure sales tactics in buying an alarm system and be sure the written contract contains all oral representations made by the salesperson. Check out the company with the BBB. The FTC’s Cooling-Off Rule gives you three days to cancel a sale made in your home.

Randy Hutchinson is the president of the Better Business Bureau of the Mid-South. Reach the BBB at 800-222-8754.