2.27.21 – The Advocate

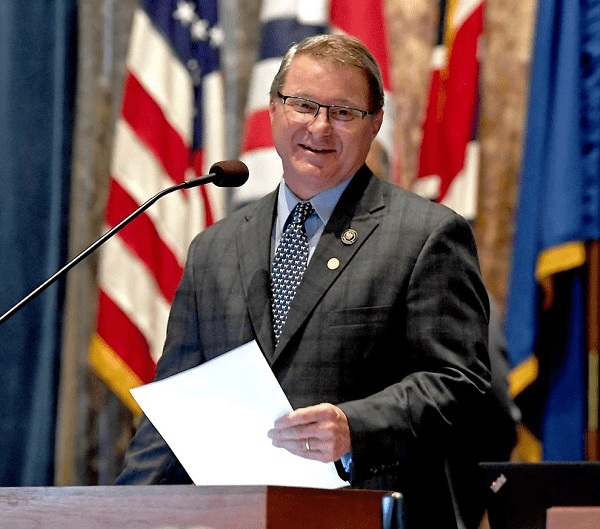

The work of revamping the state’s tax system, which has been going on for weeks behind the scenes, became public Friday when Senate President Page Cortez released an announcement signed by leaders in both chambers.

“In the upcoming Legislative Session, beginning on April 12th, we are putting together a plan to fundamentally change our tax structure,” the eight leaders wrote in a communal letter addressed to “the people of Louisiana.”

“We’re looking to do a package and to put forward an initiative,” Cortez told reporters after Gov. John Bel Edwards administration introduced the executive budget proposal off which legislators will build the state’s spending plan for the 2022 fiscal year that begins July 1, 2021.

Cortez said legislators want to create a simpler system that makes taxes more stable and predictable.

A tax system revamp for Louisiana is in the works with one overall goal: lowering rates

Gov. John Bel Edwards said Thursday at a town hall sponsored by The Advocate / The Times-Picayune that he is open to revamping the tax system, which could include lowering income tax brackets. He added, however, that he would not allow any tax reform “to create that structural deficit I inherited.”

Changes to the tax system between 2006 to 2008 effectively lowered collections. But lawmakers refused to make corresponding cuts to popular services, leaving state government struggling to find enough money to pay the bills year after year. After a series of back-to-back-to-back special legislative sessions frequented with often bitter rhetoric, Edwards and legislators raised sales taxes and made fiscal policy changes to stabilize the state’s revenue picture.

Wall Street recently praised the efforts and improved the state’s credit rating.

Louisiana’s tax sticker price looks pretty high at first glance. But a passel of exemptions, credits and deductions trim what taxpayers owe to a fairly low amount.

For instance, Louisiana’s personal income tax rates – from 2% for taxpayers to 6% for taxpayers making more than $50,000 a year – ranks Louisiana 14th highest nationally. But after calculating the various tax breaks, the average amount paid by individual taxpayers puts Louisiana as the ninth lowest.

One such break allows higher income taxpayers, who file deductions on their federal income tax returns, to claim that amount and reduce what they owe Louisiana.

Only one other state allows a deduction for federal income tax deductions. Removal of that tax break, which will require a change to the state Constitution, would allow state government to collect hundreds of millions of dollars more.

Cortez said the money realized from removing the federal income tax deduction can be used to lower the income tax rates.

Edwards said he is open to elimination of deduction of federal deductions on state income taxes.

The idea of updating the state’s tax system, removing special interest exemptions, and lowering overall rates has been on the table for years.

At the beginning of Edwards’ term in 2017, a blue-ribbon investigatory task force – manned by economists, academics, analysts, and bureaucrats – did a study and came up with a checklist of recommendations to reform Louisiana’s system. None of those ideas ever gained traction enough to become law because a number of lawmakers complained that no budget cuts were included.

Still, the way Louisiana taxes and collects over the years has been layered with dozens of novel solutions, sought mostly by special interests, that lowers the amount of taxes owed.

For instance, few states tax businesses on the inventory the companies have on hand. Louisiana does.

Inventory taxes, the business community claims, keep companies from moving here or expanding once they are here. It also is one of the key revenue sources for local governments.

Legislators a couple of decades ago came up with a work around for the inventory tax. Local government could still charge the tax, but state government would issue credits, essentially using state dollars to repay the business for what locals collected.

Legislators want to phase out the property tax on business inventory. Cortez says it can only be done if another source of revenue can be found for local governments.

Among the proposals that will be introduced for debate, according to the letter:

• Centralizing state and local sales tax collection. Louisiana is one of three states where local jurisdictions collect their own sales taxes.

• Reducing and simplifying the corporate franchise tax, which effectively charges companies for doing business in the state and calculated off net worth, rather than income.