2.19.21 – AP – BY EMILY WAGSTER PETTUS ASSOCIATED PRESS

The Mississippi Senate is pushing to revise tax credits and other incentives for business that move to the state or expand their existing operations.

Senators voted unanimously Thursday to pass Senate Bill 2822, the Mississippi Flexible Tax Incentive Act, also called MFLEX.

Parker also said any business receiving tax credits would be required to file an annual report to the state, providing accountability to the public. He said incentives would be awarded based on the number of jobs created, not the number of jobs promised. For example, he said if a company says it has a goal of creating 50 jobs but creates 45, the incentives would be adjusted.

“This will be very easy for you to explain, as a senator, to someone who is considering moving into your area,” Parker said. “Whereas now, the application process for the multiple incentives we have are hundreds and hundreds of pages that are — it’s a lot of legalese, it’s a lot of difficult paperwork to kind of navigate.”

Republican Lt. Gov. Delbert Hosemann is pushing for the changes.

“We had someone in our office looking at this just recently, and we told him ‘If you can tell me how much you’re going to pay your people and how much you’re going to put in the ground and how much your soft costs are, we can calculate your benefits sitting here,’ and it was wildly well received,” Hosemann said.

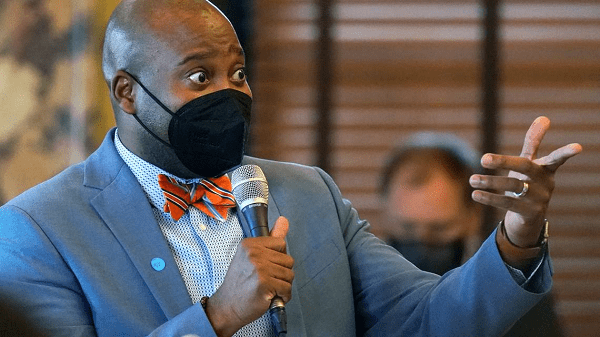

Democratic Sen. Derrick Simmons of Greenville said the proposal could provide transparency for the public.

“We’ve seen so many situations where we’ve given taxpayer dollars away, and there’s just no accountability,” Simmons said.

The bill will move to the House for more work in coming weeks.