12.2.20 – SSI

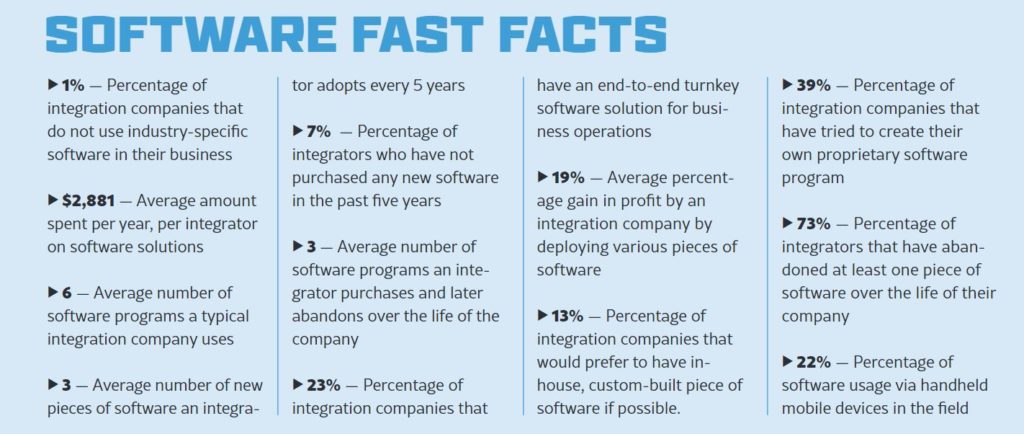

SSI’s Software Deep Dive Study fınds security contractors spend $2,881 per year on business software solutions and employ an average of six programs to manage their operations.

The days of the shoebox full of receipts and invoices for operating an integration company are certainly long gone. Indeed, dealers of all demographics clearly have embraced computer software solutions to run their businesses more efficiently and more profitably.

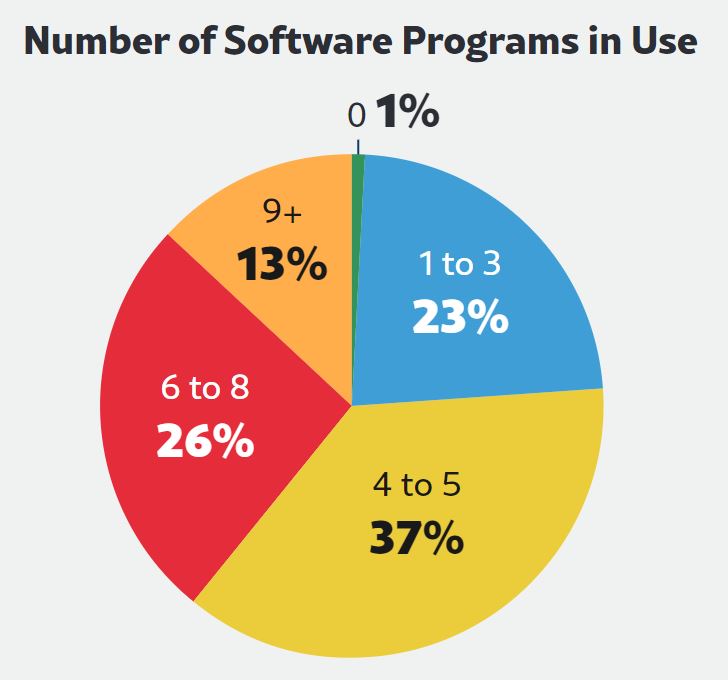

According to the first-ever SSI Software Deep Dive Study, the typical security dealer/integration company spends $2,881 per year on business software solutions — both off-the-shelf and industry-specific — and uses on average six software programs to run their operation.

The study, which was conducted during October 2020, reached a broad swath of integration firms, including security, commercial A/V and residential custom professionals, and had 169 usable responses.

Among the other key takeaways from the Deep Dive Study are:

- Only 1% of integration companies report they do not use business software for their company operations management.

- Accounting/billing/payroll software is by far the most prevalent software used in the industry.

- Nearly one in four integration companies use a turnkey business management software solution.

- Nearly three out of every four integrators have abandoned a piece of software during the life of their company.

- Outgrowing a particular software program is the primary reason dealers drop it.

- Nearly four in 10 dealers have tried to write their own custom software program for a particular function.

- Software provides a definite boost to the bottom line — nearly 20%, survey respondents report.

Those are just some of the factors in play as integrators rely on software programs to help run their businesses. Software has become a vital part of any integration company’s business.

The more quickly and efficiently menial tasks can be performed using software, the more time can be spent on the enjoyable parts of the business, such as interacting with clients and designing systems. After all, no one got into the integration business because they had an overwhelming desire to spend countless hours doing payroll and sweating over spreadsheets!

Debating Turnkey vs. Single-Function Software

For years, turnkey software solutions for integration businesses have typically been reserved for larger firms, but nearly one in four integrators report they now utilize a multipurpose software solution.

These end-to-end solutions, from companies like ProjX360, D-Tools, Simply Reliable, SimPRO, iPoint, WeSuite and others, often include the ability to create proposals, manage inventory, track marketing, schedule technicians, calculate payroll, send billing and more.

The end-to-end solutions gained steam over the years as integration companies found themselves juggling multiple pieces of software that did not communicate seamlessly with each other. That meant inputting the same data multiple times in different pieces of software, which can lead to human error.

According to the SSI study, 23% of dealers are actually using turnkey software solutions. In all, more than one in three integrators (34%) say they prefer a turnkey solution versus toggling among multiple apps.

Of course, even having a turnkey solution in place does not preclude an integrator from needing a single-purpose software solution. For example, if an integrator wants to use a GPS tracking software for his fleet, that will require a specialized piece of software that is not among the functions that any end-to-end solution can provide.

That is why respondents to the survey said the determination of whether or not they choose a particular software depends greatly on the task.

Another recent trend in software is being Cloud-based. Previously, integrators had to invest heavily into a software solution that was housed on dedicated computers at their office or in their own laptops in the field. It was often cost prohibitive, and required constant updates as the data and specs for various manufacturers changed.

On the positive side, the data was 100% secure on a dealer’s own servers, and it was incredibly fast because the information was not being transmitted up the Cloud and back, making you beholden to your Internet connection. Instead, Cloud-based solutions offer a lower-cost model whereby integrators pay a monthly fee to a software provider that is keeping all the manufacturer specs up to date in the Cloud.

That software-as-a-service (SaaS) business model has greatly expanded the market for those dealers who can afford a turnkey solution without a large financial outlay. The drawbacks, of course, are potentially slow upload and download speeds, as well as the risk for cyberattacks.

Costs & Preferred Functions

SaaS also might be one reason software expenditures are so low. According to the study, the average integration company spends less than $3,000 per year on software — $2,881 to be exact. And price is important, as noted by the prevalence of SaaS.

Price is by far listed as the most important criterion for choosing software, with 39% of integrators saying it is the most important factor. Just under 8% of integrators report spending less than $100 per year on software, while 9% of dealers say they spend more than $10,000 per year on average.

As noted, accounting/billing/payroll software is easily the most prevalent software used in the industry, with 82% of professionals using computer software to pay staff, bill clients and track account receivables/payables.

Actually it’s hard to imagine that any company does not use computer software for billing; however, in the residential custom electronics industry specifically, there remain a number of sole entrepreneur integration companies where the owner considers it a “lifestyle business” or even a part-time pursuit.

In many cases, dealers start with simple, off-the-shelf solutions such as MS Word for proposals, Google Gmail for email, MS Office 365 and Teams for staff communication, Google Drive for file sharing, and MS Excel for spreadsheets. The most ubiquitous off-the-shelf software in use is Intuit QuickBooks accounting software.

So with many generic business software programs in use, it is not surprising to note that the typical integration company is using six pieces of software to run his or her business. In general, dealers tend to be very loyal once they choose a piece of software.

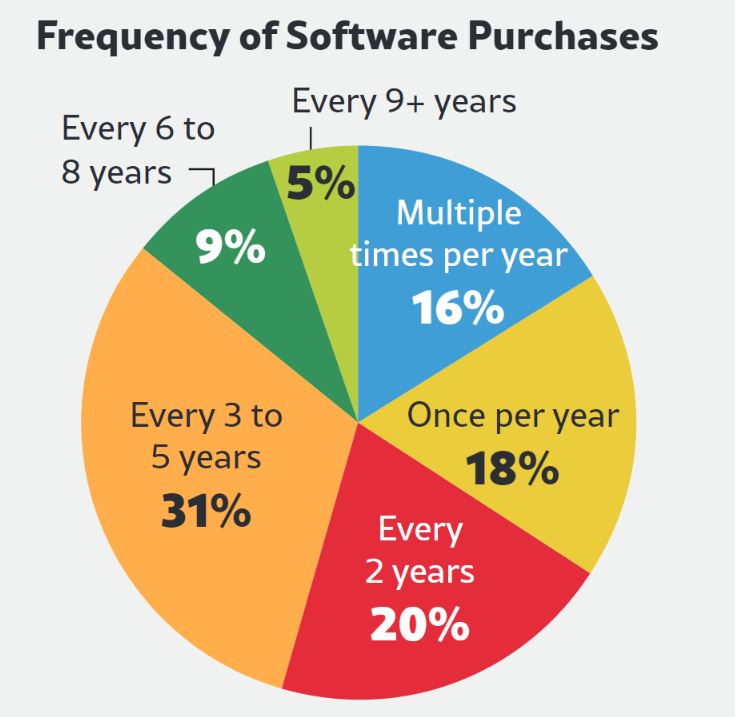

Dealers report they have abandoned three pieces of software over the lifespan of their company. The average company age responding to the study was 21 years old — that means dealers only drop a piece of software once every seven years.

And why do they change software? The biggest reason is that they simply outgrow it. In all, 31% of integrators report the reason they abandoned a particular software program/app was simply because the integration company outgrew it. Expense is the second most common reason a piece of software is dropped, followed by bugs in the software and incompatibility with other programs.

Primary Benefits & Finding Software

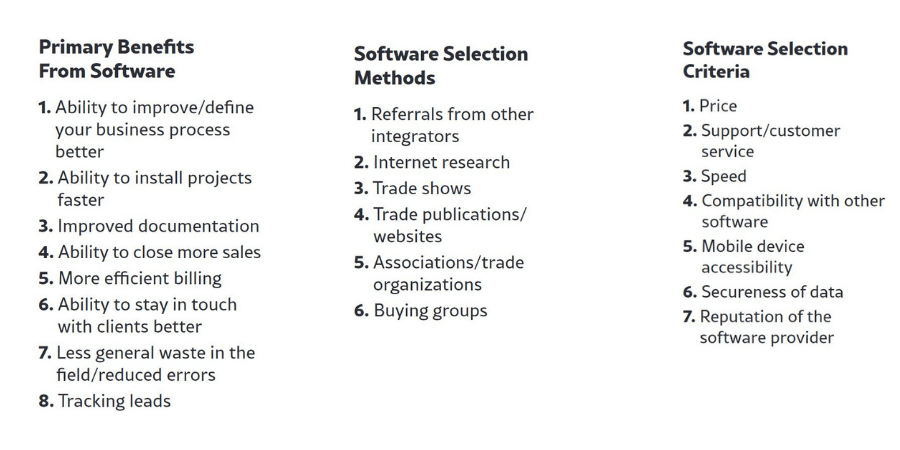

Nearly one in four integration companies (24%) say the ability to improve or define their business process better is the No. 1 benefit they get from software, followed by the ability to install projects faster, improved documentation, and the ability to close more sales. Many of those improvements go straight to the bottom line.

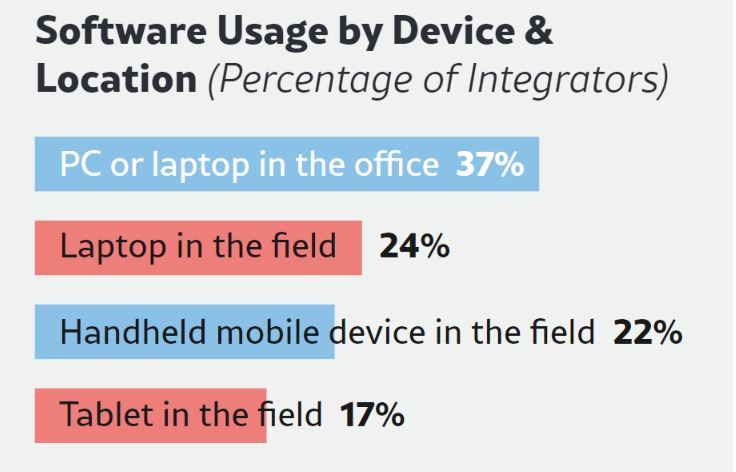

Integration companies report a 19% average boost in their bottom-line profit by using software. One helpful way dealers are becoming more efficient than ever using software is the ability to access it in the field on a mobile device. That was once a rare situation, but today, 22% of the software interaction is taking place via handheld mobile device.

Dealers value their peers’ input when considering software. When asked to rank how they vet new software candidates, asking their peers for referrals was by far the No. 1 reason given, with 30% of integrators citing it as their main avenue of analysis.