5.25.21 – CEPro

Author Mike Michalowicz outlines key cash management tips such as using multiple bank accounts, constraining revenue & more in CE Pro VIP Peer-to-Peer group webinar.

Do you want to put your integration company on the path to being permanently profitable? To “Profit First,” as author and business expert Mike Michalowicz explains, it can be done by implementing several straightforward steps … and yes, you can basically begin immediately.

Michalowicz shared key steps of his cash management system, fully explained in his book, “Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine,” during an exclusive hour-long webinar for members of CE Pro’s VIP Peer-to-Peer Networking Group held recently (integrators can reach out to Emerald’s Olivia Moriarty at Olivia.Moriarty@emeraldx.com for VIP Peer-to-Peer group information).

Leveraging anecdotes and some harsh economic realities from his own experience running companies in the IT/managed services space, along with well-crafted analogies, Michalowicz walked attendees through ways to build toward permanent profitability with a system tied to how you allocate income.

His “Profit First” strategy works on a premise when we are faced with being more frugal, we become more innovative as well and figure out solutions around it. He likened it to buying and consuming a tube of toothpaste – “Did you ever notice how quickly you go through it when it’s new? When it’s nearly empty you roll up the end, bend it … we can keep stretching [how long it lasts],” he notes.

For integrators, ensuring you are rewarding/compensating your own hard work first and not last (along with other cash management measures) will help foster habits toward greater profitability, Michalowicz says.

Here are four key tips the author presented to the CE Pro VIPs:

1. SET UP MULTIPLE BANK ACCOUNTS FOR REVENUE ALLOCATION

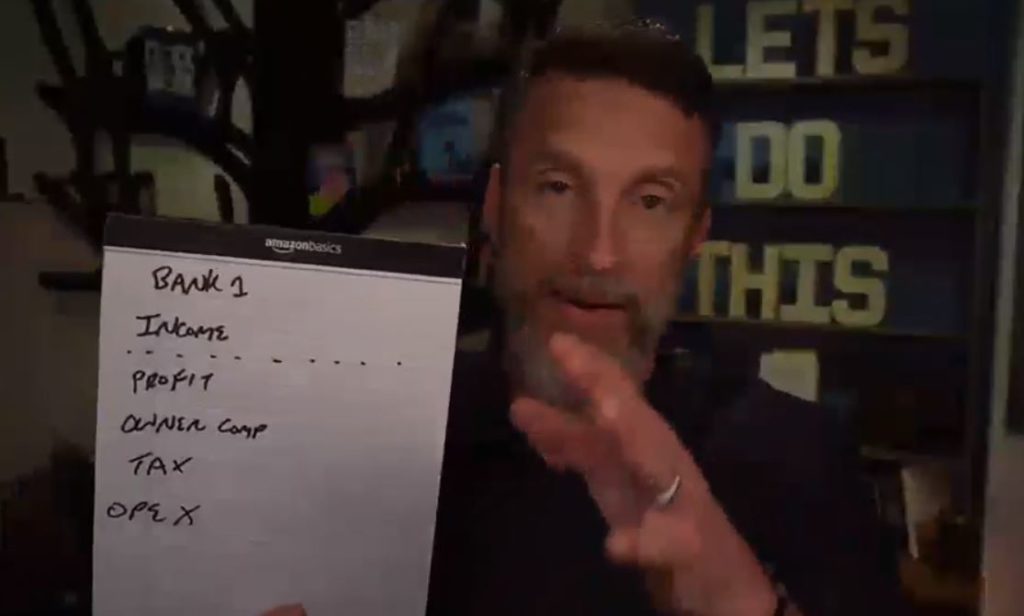

There are five “foundational” accounts Michalowicz employs to carve up the “cash turkey” he calls income, which represents the account that feeds the other four: profit, owner’s compensation, tax and operating expenses.

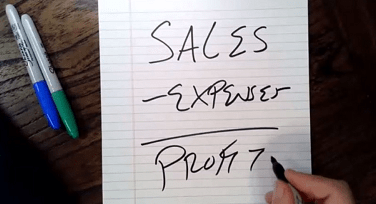

This helps flip the formula of “sales – expenses = profits” so profits moves up from the bottom-line, or how many are taught as the “right” way of running a business. As its name suggests, in the “Profit First” method, those sales get distributed partially into that “profit” account, so it is prioritized.

As elaborated on in his book, with research based on 600,000 “Profit First” business models, according to Michalowicz, integrators can determine what percentage of income gets divvied into which bank accounts.

He asked attendees if they own any public stock. “Everyone owns stock in their own business – a lot,” he continued. “You are a shareholder, and if you own it outright it’s 100%. A profit account is like a stock reward to yourself.”

2. FOLLOW THE RIGHT CASH DISTRIBUTION FLOW

Beyond setting up those foundational accounts, it’s important to understand the proper order in which to transfer money as it’s generated. Because as Michalowicz points out, “Profit First” is a behavioral change foremost, with the changes happening to how you look at cash flow and how you avoid falling into pitfalls that will hinder the process.

In his system, the cash management expert created a “reward, reward, reward, protect and serve” allocation path. Based on your own calculations, revenues that go into the income account are distributed first to the profit account (hence the book title), then to owner’s compensation. The percentage going to taxes covers that always looming elephant, and the remaining chunk is for running the business.

Constraining income in this manner will help integrators immediate face some hard truths about their financial situation, particularly with ebbs and flows of cash. “If you can’t pay your bills, that’s your business telling you you can’t afford your bills,” he says, and owners will adjust by figuring out how reduce costs, amplify margin, rid themselves of low-productivity personnel, etc.

3. REMOVE TEMPTATIONS (AKA ADD MORE BANK ACCOUNTS TOO)

The easiest way for someone on a diet to resist that sugar urge is to leave the treats at the grocery store, Michalowicz says. And while it might be tempting to similarly dip into those profit and tax accounts that are steadily growing for whatever purpose, it’s best to resist (though ideally integrators will already be mostly or completely debt-free to optimize the system, and rectifying debt via profits at first might be a first step).

For “out of sight, out of mind,” he suggests finding a bank to establish “profit hold” and “tax hold” accounts to ward off temptation and instead as they accumulate in the original accounts, begin transferring money to hold securely. That way, you aren’t “stealing from yourself” when you really want to just “borrow” some here and there.

4. CONSIDER THE 10/25 & 90-DAY RULES

In this system, two ways to develop “muscle memory” so this behavioral habit does not atrophy over the years, Michalowicz advises, involve following “set it and forget it” type rules.

The first is the “10/25 Rule,” in which you have the 10th of the month and 25th of the month, for instance, as trigger days for allocations so it is automatic as a habit.

Meanwhile, he suggests that every 90 days your company reaps the rewards of your profits, much in the way a public company rewards its stockholders – share the profit hold and then begin refilling it.

The best part? Integrators can begin implementing the system immediately, the author notes; all it takes is a trip to the bank, which you might not even need to leave the office for these days.

ABOUT THE AUTHOR

Arlen Schweiger is executive editor of CE Pro and former managing editor of sister publications Commercial Integrator and Security Sales & Integration. Arlen contributes installation features, business profiles, manufacturer news and product reviews. View Arlen Schweiger’s complete profile